Fill Out a Valid Business Credit Application Template

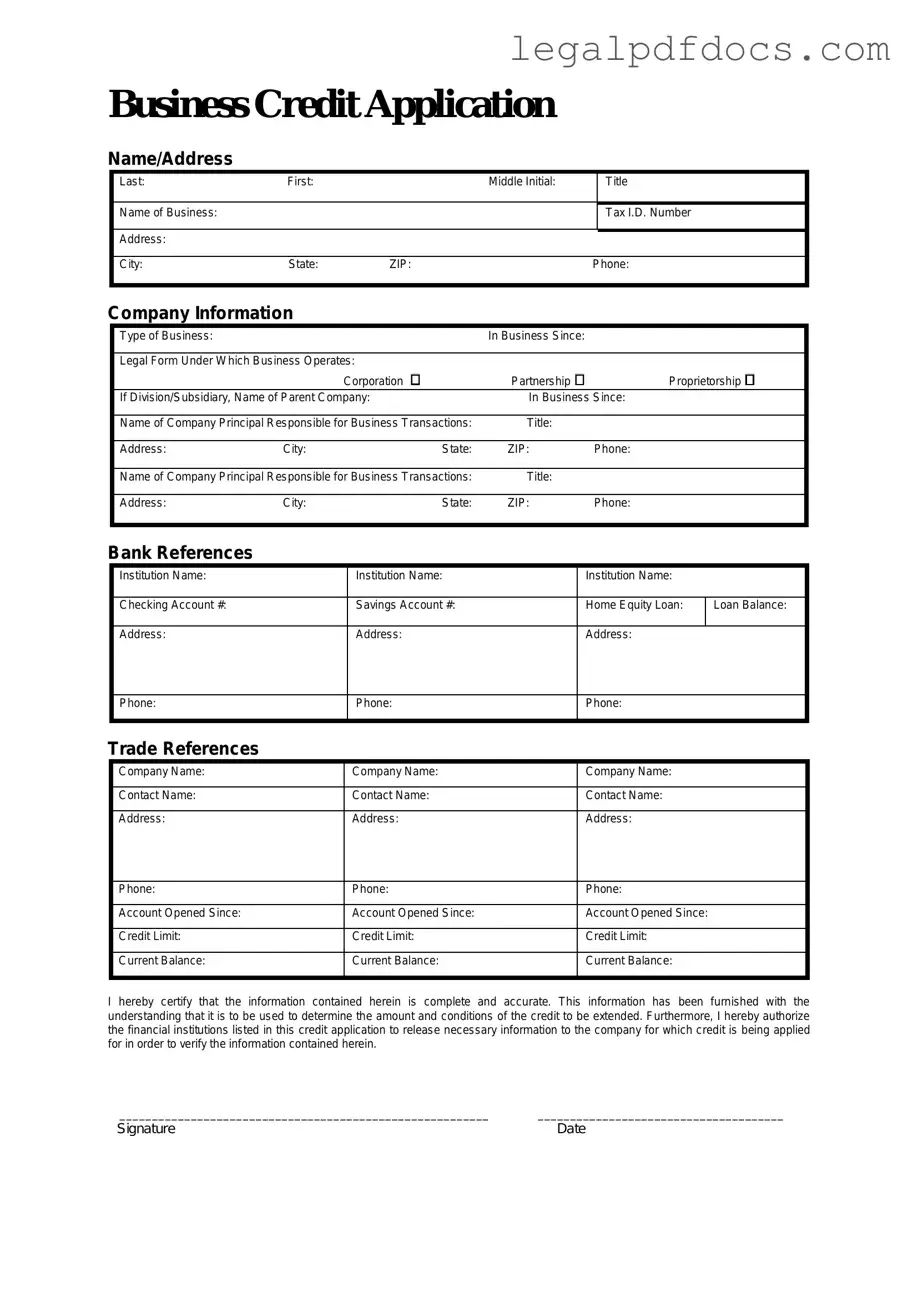

When seeking to establish a business relationship with suppliers or lenders, a Business Credit Application form plays a crucial role in the process. This form gathers essential information about the business, including its legal structure, ownership details, and financial history. Typically, applicants are required to provide their Employer Identification Number (EIN), business address, and contact information. Additionally, the form often requests references from other creditors, which helps potential lenders assess the applicant's creditworthiness. Financial statements, such as balance sheets and income statements, may also be requested to provide a clearer picture of the business's financial health. Completing this form accurately and thoroughly is vital, as it lays the groundwork for trust and transparency between the business and its potential partners. Properly filling out the Business Credit Application can facilitate smoother transactions and foster long-term relationships, ultimately contributing to the growth and success of the business.

Dos and Don'ts

When filling out the Business Credit Application form, it’s important to approach the task carefully. Here are some guidelines to help you through the process.

- Do: Provide accurate and complete information. Double-check your entries to ensure there are no mistakes.

- Do: Include all required documentation. This may include financial statements or tax returns, depending on the lender's requirements.

- Do: Be honest about your business's financial situation. Transparency can build trust with the lender.

- Do: Review the application thoroughly before submission. Take a moment to ensure everything is in order.

- Don't: Leave any sections blank. If a question does not apply, write "N/A" instead of skipping it.

- Don't: Provide misleading information. Misrepresentation can lead to denial of credit or legal issues.

- Don't: Rush through the application. Take your time to ensure clarity and accuracy.

- Don't: Ignore the lender's specific instructions. Follow their guidelines carefully to avoid complications.

How to Use Business Credit Application

Completing the Business Credit Application form is an important step in establishing a credit relationship with a lender. Once you have filled out the form, it will be reviewed by the lender to determine your eligibility for credit. Follow these steps carefully to ensure all necessary information is provided accurately.

- Begin by entering your business name in the designated field.

- Provide the business address, including street, city, state, and zip code.

- Indicate the type of business structure (e.g., sole proprietorship, partnership, corporation).

- Fill in the date the business was established.

- List the primary contact person's name and title within the company.

- Include the contact phone number and email address for the primary contact.

- State the federal tax identification number (EIN) for the business.

- Detail the business's annual revenue and the number of employees.

- Provide information about the business's banking institution, including the bank's name and contact information.

- List any trade references, including names and contact information for at least three vendors or suppliers.

- Review the completed form for accuracy and completeness.

- Sign and date the application to certify that the information is true and accurate.

After submitting the completed form, you will await a response from the lender regarding your application status. It is advisable to keep a copy of the submitted form for your records.

More PDF Templates

Electrical Load Calculations - It helps in determining the need for additional circuits.

Profits or Loss From Business - Keeping thorough records simplifies the process of completing Schedule C.

T47 Paralympics - This affidavit can prevent misunderstandings relating to property ownership.

Documents used along the form

When applying for business credit, several documents can support your application and provide lenders with the information they need to make informed decisions. Each document plays a unique role in presenting your business's financial health and credibility.

- Personal Guarantee: This document is a promise from the business owner to repay the debt personally if the business cannot. It adds a layer of security for the lender.

- Business Plan: A detailed plan outlining your business goals, strategies, and financial projections. This helps lenders understand your vision and how you plan to achieve it.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They provide a snapshot of your business’s financial health over a specific period.

- Tax Returns: Providing personal and business tax returns for the past few years helps lenders assess your income and tax obligations.

- Bank Statements: Recent bank statements show cash flow and financial stability, giving lenders insight into your day-to-day operations.

- Trade References: Contact information for other businesses that have extended credit to you. This helps establish your creditworthiness based on past relationships.

- Legal Documents: This can include your business license, articles of incorporation, or partnership agreements. These documents verify the legitimacy of your business structure.

Gathering these documents can streamline the credit application process and improve your chances of approval. Presenting a complete and well-organized application demonstrates professionalism and readiness to engage with potential lenders.

Misconceptions

Understanding the Business Credit Application form is crucial for both business owners and lenders. However, several misconceptions can lead to confusion and missteps. Below are some common misunderstandings regarding this important document.

- It is only for large businesses. Many believe that only large corporations need to fill out a Business Credit Application. In reality, businesses of all sizes, including small startups, can benefit from establishing credit.

- It guarantees credit approval. Some applicants assume that submitting the form automatically ensures they will receive credit. Approval depends on various factors, including credit history and financial stability.

- Personal credit does not matter. There is a misconception that personal credit scores are irrelevant for business credit applications. In many cases, lenders will consider personal credit, especially for new businesses without an established credit history.

- All lenders use the same criteria. Many believe that all lenders evaluate applications in the same way. Each lender has unique criteria, which can affect the likelihood of approval and the terms offered.

- Filling it out is a one-time task. Some think that once the application is submitted, no further action is needed. In truth, maintaining good credit often requires regular updates and communication with lenders.

- It is a simple form with no complexities. While the form may seem straightforward, it often requires detailed financial information and can be complex. Applicants should take their time to ensure accuracy.

- Only financial information is required. Many assume that only financial details are necessary for the application. However, lenders may also seek information about the business structure, management, and operational history.

- Once approved, credit terms cannot change. Some believe that once they receive credit approval, the terms are set in stone. Lenders can reevaluate credit terms based on changes in financial circumstances or payment history.

By addressing these misconceptions, business owners can approach the credit application process with a clearer understanding, ultimately leading to more informed decisions and better outcomes.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | Typically, the form requires details such as business name, address, tax identification number, and financial information. |

| State-Specific Forms | Some states may have specific requirements or variations of the form, governed by local business laws. |

| Confidentiality | Information provided on the form is usually kept confidential and used solely for credit evaluation purposes. |

Key takeaways

When filling out and using the Business Credit Application form, there are several important points to keep in mind. These key takeaways can help ensure a smooth application process and increase the chances of approval.

- Provide Accurate Information: Always double-check the information you enter. Inaccurate details can lead to delays or rejection of your application.

- Know Your Business Structure: Be prepared to specify whether your business is a sole proprietorship, partnership, corporation, or LLC. This information is crucial for the lender.

- Financial History Matters: Include relevant financial statements and documents. Lenders want to see your business’s financial health, so provide clear and comprehensive records.

- Credit References: List reliable credit references. These could be suppliers or other businesses that can vouch for your payment history and creditworthiness.

- Understand Terms and Conditions: Read through the terms and conditions carefully. Knowing what you’re agreeing to is essential before signing the application.

- Follow Up: After submitting the application, don’t hesitate to follow up. A polite inquiry can demonstrate your interest and help you stay informed about the status.

- Be Prepared for Questions: Be ready to answer any questions the lender may have. They may seek clarification on certain aspects of your application.

By keeping these takeaways in mind, applicants can navigate the Business Credit Application process more effectively and enhance their chances of securing the credit they need for their business.