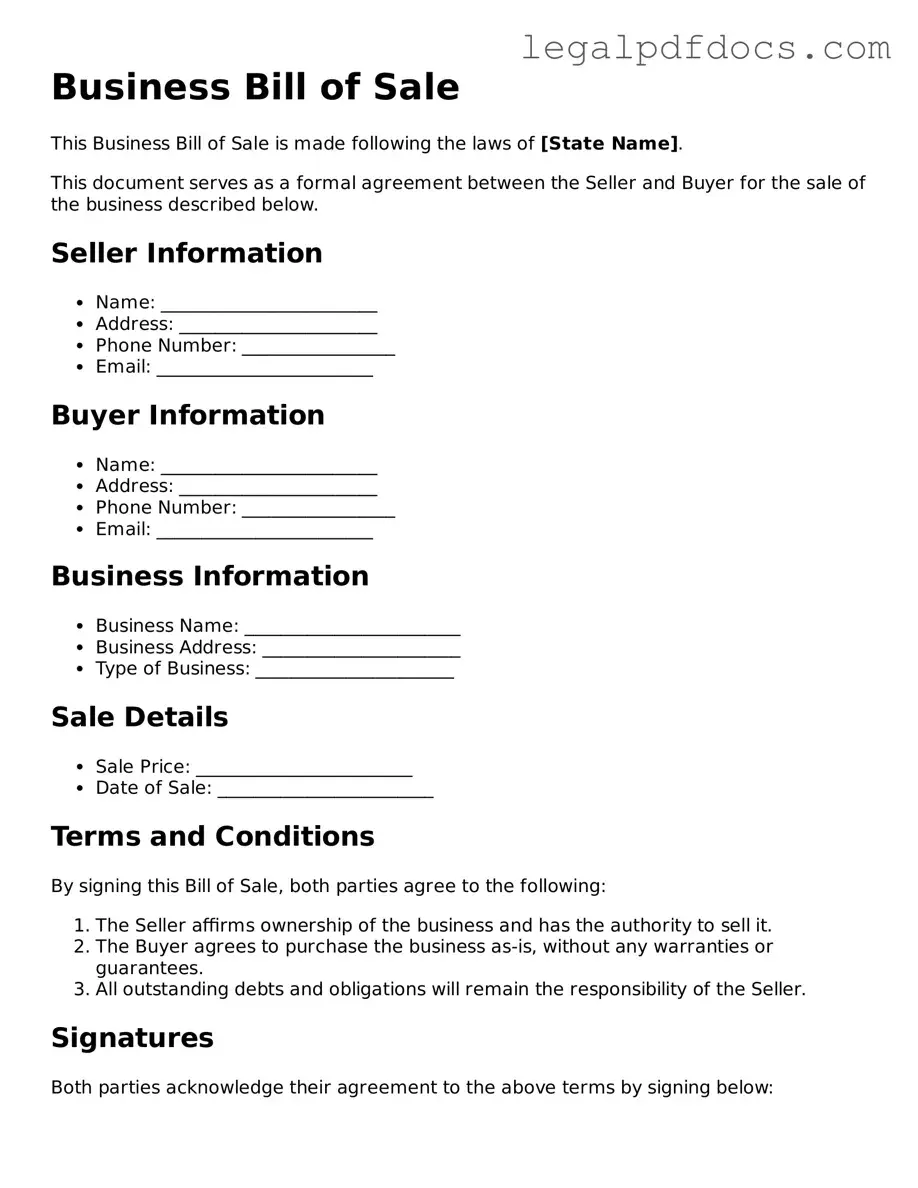

Business Bill of Sale Template

When it comes to transferring ownership of a business, clarity and documentation are key. A Business Bill of Sale form serves as a crucial tool in this process, capturing essential details that protect both the seller and the buyer. This document typically outlines the names and addresses of the parties involved, a description of the business being sold, and the terms of the sale, including the purchase price and payment method. Additionally, it may include any warranties or representations made by the seller, ensuring that the buyer is fully informed about what they are acquiring. By providing a formal record of the transaction, the Business Bill of Sale not only facilitates a smooth transfer of ownership but also serves as a legal safeguard in case disputes arise in the future. Understanding the components and significance of this form can empower business owners to navigate the sale process with confidence and clarity.

Dos and Don'ts

When filling out the Business Bill of Sale form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do: Provide accurate business information, including the legal name and address.

- Do: Clearly describe the items or assets being sold, including any relevant details.

- Do: Include the sale price and payment terms to avoid misunderstandings.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank, as this may lead to confusion or disputes later.

- Don't: Use vague language when describing the items sold; specificity is key.

- Don't: Forget to include any warranties or guarantees associated with the sale.

- Don't: Rush through the process; take your time to ensure all information is correct.

- Don't: Ignore local laws or regulations that may apply to the sale.

How to Use Business Bill of Sale

After obtaining the Business Bill of Sale form, you will need to provide specific details about the transaction. This information is essential for both parties involved in the sale. Follow these steps to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Fill in the names and addresses of both the seller and the buyer. Ensure that all details are correct.

- Provide a description of the business being sold. Include the business name, type, and any relevant identification numbers.

- State the purchase price clearly. Make sure this amount is agreed upon by both parties.

- Indicate the method of payment. Specify if it is cash, check, or another form.

- Include any terms or conditions of the sale, if applicable. This may cover warranties or liabilities.

- Both parties should sign and date the form at the bottom. This confirms their agreement to the terms outlined.

Once completed, retain copies for both the seller and the buyer. This ensures that both parties have a record of the transaction.

Check out Popular Types of Business Bill of Sale Templates

Motorcycle Bill of Sale Template - Can assist in the sale of custom or modified motorcycles.

Bill of Sale for a Horse - The form contributes to transparency, ensuring both parties know the terms of the sale.

Documents used along the form

A Business Bill of Sale is an essential document that records the transfer of ownership of a business from one party to another. However, several other forms and documents often accompany this transaction to ensure clarity and legal compliance. Here are five important documents that you might encounter in conjunction with a Business Bill of Sale:

- Asset Purchase Agreement: This document outlines the specific assets being sold, including equipment, inventory, and intellectual property. It details the terms of the sale, including payment methods and timelines, ensuring both parties understand what is included in the transaction.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during the sale process. It prevents either party from disclosing confidential details about the business, ensuring that trade secrets and proprietary information remain secure.

- Lease Assignment: If the business operates from a rented location, a lease assignment may be necessary. This document transfers the lease agreement from the seller to the buyer, allowing the new owner to continue using the premises without interruption.

- Bill of Sale for Equipment: If specific equipment is part of the sale, a separate bill of sale for that equipment may be required. This document provides detailed information about the equipment being sold, including its condition and any warranties or guarantees.

- Tax Clearance Certificate: This certificate verifies that the seller has paid all necessary taxes related to the business. It protects the buyer from any potential tax liabilities that may arise after the sale is completed.

In summary, while the Business Bill of Sale is a critical component of a business transaction, these accompanying documents play vital roles in ensuring a smooth transfer of ownership. Each document serves a specific purpose, helping both parties navigate the complexities of the sale process with confidence.

Misconceptions

Understanding the Business Bill of Sale form is essential for anyone involved in a business transaction. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It is only necessary for large transactions. Many people believe that a Bill of Sale is only needed for significant sales. In reality, it can be beneficial for any transaction involving the transfer of business assets.

- It is the same as a purchase agreement. Some individuals think these two documents are interchangeable. While both serve to document a sale, a Bill of Sale is typically simpler and focuses on the transfer of ownership.

- It does not need to be signed. A common misconception is that a Bill of Sale can be valid without signatures. In most cases, both the buyer and seller should sign the document to confirm the transaction.

- It is only for tangible assets. Many assume that the form is only applicable to physical items. However, it can also be used for intangible assets, such as intellectual property or business goodwill.

- It does not require any specific information. Some believe that a Bill of Sale can be vague. In fact, it should include detailed information about the transaction, such as the date, parties involved, and a description of the assets.

- It is not legally binding. There is a misconception that a Bill of Sale has no legal weight. When properly executed, it can serve as a binding contract and provide legal protection for both parties.

- It is only needed in certain states. Some think that the requirement for a Bill of Sale varies by location. While laws can differ, many states recognize the importance of this document for various transactions.

- It is not necessary if there is a written contract. Some believe that if a formal contract exists, a Bill of Sale is redundant. However, having both documents can provide additional clarity and protection.

- It can be created after the sale is completed. Many think that a Bill of Sale can be drafted post-transaction. Ideally, it should be completed at the time of sale to ensure all details are accurately recorded.

Being aware of these misconceptions can help ensure that business transactions proceed smoothly and legally. Always consider consulting a professional when dealing with important documents.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. |

| Purpose | This form serves to protect both the buyer and the seller by providing a written record of the transaction, detailing what is being sold and the terms of the sale. |

| State-Specific Forms | Each state may have its own version of the Business Bill of Sale, governed by local laws. For example, California's form adheres to the California Commercial Code. |

| Essential Elements | Key components of the form include the names of the parties involved, a description of the business or assets, the sale price, and the date of the transaction. |

| Signatures | The form must be signed by both the seller and the buyer to be legally binding, often requiring witnesses or notarization depending on state laws. |

Key takeaways

When engaging in a business transaction, a Business Bill of Sale serves as a crucial document. Here are key takeaways to consider when filling out and using this form:

- Identify the Parties: Clearly state the names and contact information of both the seller and the buyer. This ensures that both parties are easily identifiable.

- Describe the Business: Provide a detailed description of the business being sold. Include information such as the business name, location, and any relevant licenses or permits.

- Specify the Sale Price: Clearly outline the total sale price of the business. This should be an agreed-upon amount that reflects the value of the business.

- Include Payment Terms: Detail the payment method and any terms associated with the transaction. This could include payment plans or contingencies.

- List Included Assets: Enumerate all assets included in the sale. This can encompass equipment, inventory, customer lists, and intellectual property.

- Address Liabilities: Clearly state any liabilities that the buyer will assume. This might include outstanding debts or obligations related to the business.

- Signatures Required: Ensure that both parties sign the document. Signatures validate the agreement and indicate acceptance of the terms.

- Keep Copies: After signing, both parties should retain copies of the Bill of Sale. This provides a record of the transaction for future reference.

- Consult Legal Advice: It is wise to seek legal counsel when drafting or reviewing the Bill of Sale. This helps protect the interests of both parties and ensures compliance with applicable laws.

By following these guidelines, individuals can navigate the complexities of business transactions with greater confidence and clarity.