Fill Out a Valid Broker Price Opinion Template

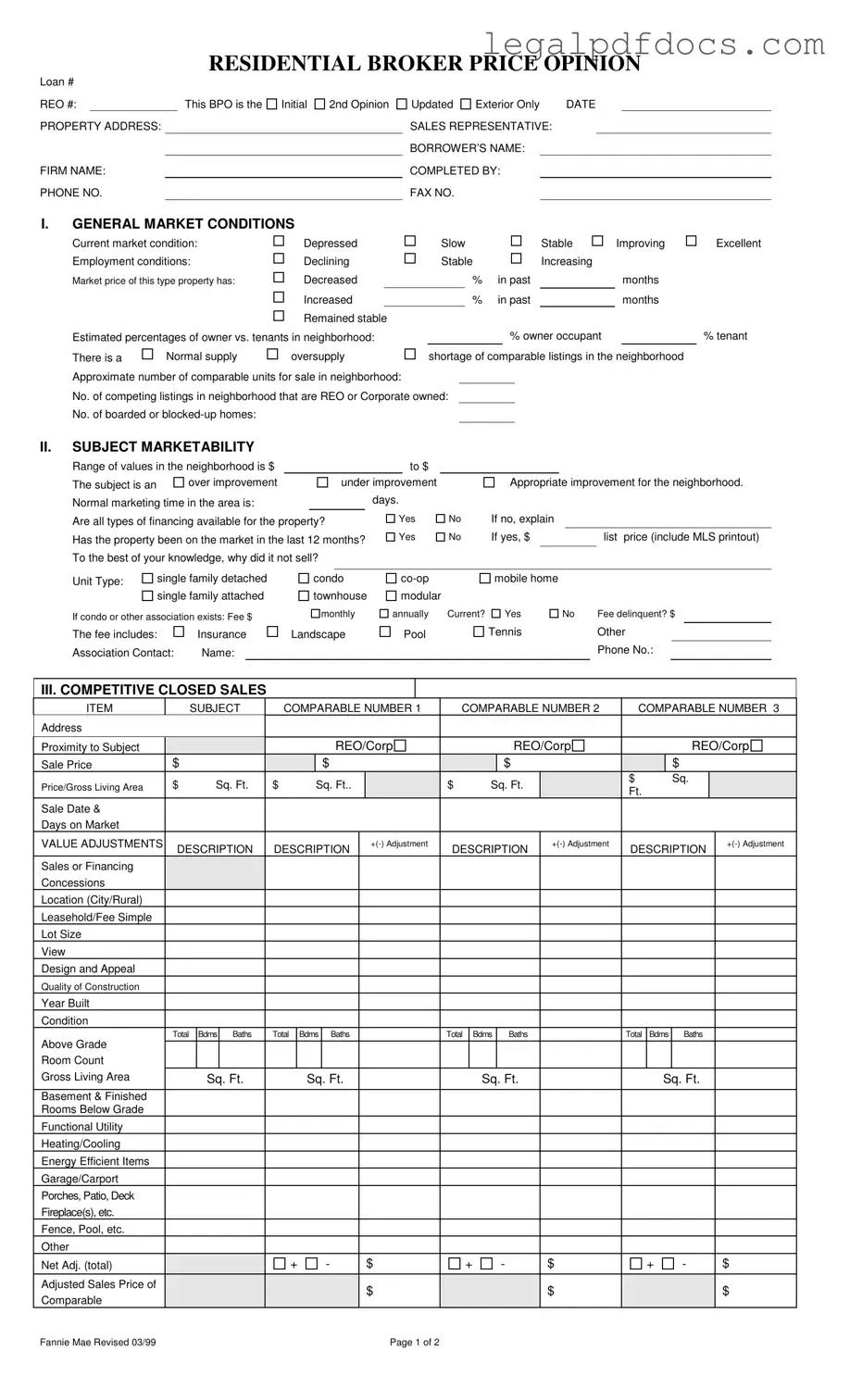

The Broker Price Opinion (BPO) form serves as a vital tool in the real estate industry, particularly for assessing the value of residential properties. This form provides a comprehensive overview of a property’s marketability and current conditions, enabling real estate professionals to make informed decisions. Key sections of the BPO include an analysis of general market conditions, which evaluates factors such as employment rates and the supply of comparable listings in the neighborhood. Additionally, the form outlines the subject property's marketability, detailing its condition and financing options. The BPO also compares the subject property with similar properties that have recently sold, allowing for adjustments based on various characteristics like location, size, and amenities. Marketing strategies and necessary repairs are also documented, ensuring that potential buyers receive a clear picture of the property’s status. Finally, the BPO concludes with a suggested market value and list price, providing a well-rounded assessment that can guide sellers, buyers, and lenders alike.

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, it's crucial to follow certain guidelines to ensure accuracy and clarity. Here are some dos and don'ts to consider:

- Do provide complete and accurate information for all sections of the form.

- Do clearly indicate the property address and relevant loan numbers at the top of the form.

- Do assess current market conditions honestly, including employment and pricing trends.

- Do include detailed descriptions of comparable properties and their adjustments.

- Do specify the occupancy status of the property and any necessary repairs.

- Don't leave any sections blank; incomplete forms can lead to misunderstandings.

- Don't exaggerate or misrepresent the condition of the property or market conditions.

- Don't overlook the importance of accurate contact information for follow-up questions.

- Don't forget to sign and date the form before submission.

How to Use Broker Price Opinion

Filling out the Broker Price Opinion form requires careful attention to detail. Each section provides important information that helps determine the value of a property. Follow these steps to complete the form accurately and efficiently.

- Begin with the top section. Fill in the Loan # and REO # fields, along with the PROPERTY ADDRESS, FIRM NAME, and PHONE NO.

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO. Specify if it’s for Exterior Only and enter the DATE.

- Complete the SALES REPRESENTATIVE, BORROWER’S NAME, and COMPLETED BY fields, including FAX NO..

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions. Choose from options like Depressed, Stable, or Increasing.

- Estimate the market price changes and the percentage of owner-occupants in the neighborhood. Fill in the approximate number of comparable listings available.

- In the SUBJECT MARKETABILITY section, provide the range of values and determine if the subject property is an over or under improvement. Note the normal marketing time and financing availability.

- Indicate if the property has been on the market in the last 12 months. If yes, include the list price and reasons for not selling.

- Specify the Unit Type and any applicable association fees, including contact details.

- Move to the COMPETITIVE CLOSED SALES section. List details for at least three comparable properties, including addresses, sale prices, and adjustments.

- Record the MARKETING STRATEGY and occupancy status. Determine the most likely buyer type.

- Itemize any repairs needed to bring the property to average marketable condition. Check recommended repairs and calculate the grand total for all repairs.

- In the COMPETITIVE LISTINGS section, provide details for comparable listings, including list prices and adjustments.

- Determine the MARKET VALUE based on the competitive closed sales. Suggest a list price for both AS IS and REPAIRED conditions.

- Finally, add any comments regarding the property, including special concerns or unique features. Sign and date the form.

More PDF Templates

S Corp Abbreviation - Once approved, the S corporation status allows corporations to avoid double taxation on income.

Consolation Bracket - The competition encourages teams to give their best performances, regardless of earlier outcomes.

Documents used along the form

The Broker Price Opinion (BPO) form is a crucial document in the real estate industry, particularly for lenders and investors looking to assess property values. However, several other forms and documents often accompany the BPO to provide a more comprehensive understanding of the property and its market conditions. Below is a list of commonly used documents that complement the BPO.

- Comparative Market Analysis (CMA): This report analyzes similar properties in the area that have recently sold, are currently on the market, or were taken off the market. It helps establish a fair market value based on real-time data.

- Property Inspection Report: Conducted by a licensed inspector, this document outlines the physical condition of the property, noting any repairs needed or potential issues that could affect its value.

- Appraisal Report: An appraisal is a professional assessment of a property's market value, conducted by a certified appraiser. It provides an unbiased opinion and is often required by lenders for financing purposes.

- Listing Agreement: This contract between a seller and a real estate agent outlines the terms of the property listing, including the duration, commission rates, and responsibilities of both parties.

- Sales Contract: This legally binding document outlines the terms of the sale between the buyer and seller, including price, contingencies, and closing details. It is critical for ensuring both parties are on the same page.

- Disclosure Statements: Sellers are often required to provide disclosures regarding the property's condition, including any known issues or defects. This protects buyers and helps them make informed decisions.

- Title Report: This document details the legal ownership of the property and any liens or encumbrances that may exist. It is essential for verifying that the seller has the right to sell the property.

- Marketing Plan: A document outlining the strategies for promoting the property, including advertising channels, open house schedules, and pricing strategies. It helps in positioning the property effectively in the market.

- Financing Options Document: This outlines the different financing options available for potential buyers, including conventional loans, FHA loans, and other financing methods, which can help buyers understand their purchasing power.

Each of these documents plays a vital role in the real estate process, providing essential information that aids in decision-making for both buyers and sellers. Understanding their purpose can enhance the effectiveness of the Broker Price Opinion and ensure a smoother transaction experience.

Misconceptions

- Misconception 1: A Broker Price Opinion (BPO) is the same as an appraisal.

- Misconception 2: BPOs are only for distressed properties.

- Misconception 3: Anyone can complete a BPO.

- Misconception 4: The BPO form is a one-size-fits-all document.

- Misconception 5: BPOs can only be completed in person.

- Misconception 6: A BPO guarantees a sale price.

- Misconception 7: BPOs are only useful for sellers.

While both BPOs and appraisals aim to determine property value, they differ significantly in purpose and detail. An appraisal is a formal valuation conducted by a licensed appraiser, often required for mortgage lending. A BPO, on the other hand, is typically less formal and is often used for quick assessments, such as for short sales or foreclosures.

This is not true. Although BPOs are frequently used for foreclosures and short sales, they can also be used for regular sales, market analysis, and investment assessments. They provide valuable insights into property values across various market conditions.

While it may seem straightforward, completing a BPO requires knowledge of the local real estate market and comparable property values. Typically, licensed real estate agents or brokers conduct BPOs, as they possess the expertise needed to provide accurate assessments.

In reality, BPO forms can vary based on the lender’s requirements or the specific property being assessed. Different forms may emphasize various aspects of the property or market conditions, making it essential for the person completing the BPO to adapt to each situation.

While many BPOs involve an in-person inspection of the property, some can be completed using data and comparable sales information available online. However, an in-person visit often provides a more accurate assessment, especially for properties with unique features or conditions.

A BPO provides an estimated value based on current market conditions and comparable sales, but it does not guarantee that the property will sell for that price. Market fluctuations and buyer interest can significantly influence the final sale price.

Many buyers also benefit from BPOs. Understanding the estimated value of a property can help buyers make informed decisions and negotiate better offers. Additionally, investors can use BPOs to assess potential investment properties.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the market value of a property. |

| Components | The form includes sections for market conditions, subject marketability, competitive sales, and marketing strategy. |

| Market Conditions | It assesses current market conditions, employment rates, and property pricing trends. |

| Subject Marketability | This section evaluates the property’s appeal and financing options available. |

| Competitive Sales | It compares the subject property to similar properties that have recently sold. |

| Repairs | The form outlines necessary repairs to make the property marketable. |

| Market Value | It provides a suggested list price based on the analysis conducted. |

| Governing Laws | State-specific BPO forms may be governed by real estate appraisal laws and regulations. |

Key takeaways

Understanding the Broker Price Opinion (BPO) form is essential for anyone involved in real estate transactions. Here are some key takeaways to help you navigate this important document.

- Market Conditions Matter: Assessing the current market conditions is crucial. Indicate whether the market is depressed, stable, or improving. This sets the stage for understanding property value.

- Know Your Comparables: The BPO requires you to analyze comparable properties. Make sure to include key details such as sale price, proximity to the subject property, and any adjustments that may affect value.

- Repairs and Improvements: Documenting necessary repairs is vital. Itemize repairs needed to bring the property to an average marketable condition. This helps potential buyers understand what they’re getting into.

- Occupancy Status: Be clear about the occupancy status of the property. Whether it’s occupied, vacant, or unknown can significantly impact the marketing strategy and potential buyer interest.

- Marketing Strategy: Clearly define your marketing approach. Whether selling "as-is" or after repairs, your strategy should align with the property’s condition and market expectations.

- Final Market Value: The final section of the BPO asks for a suggested market value. Ensure this value reflects the analysis of comparable sales and the overall market conditions.

By keeping these takeaways in mind, you can fill out the BPO form with confidence and clarity, ultimately aiding in a smoother transaction process.