Fill Out a Valid Auto Insurance Card Template

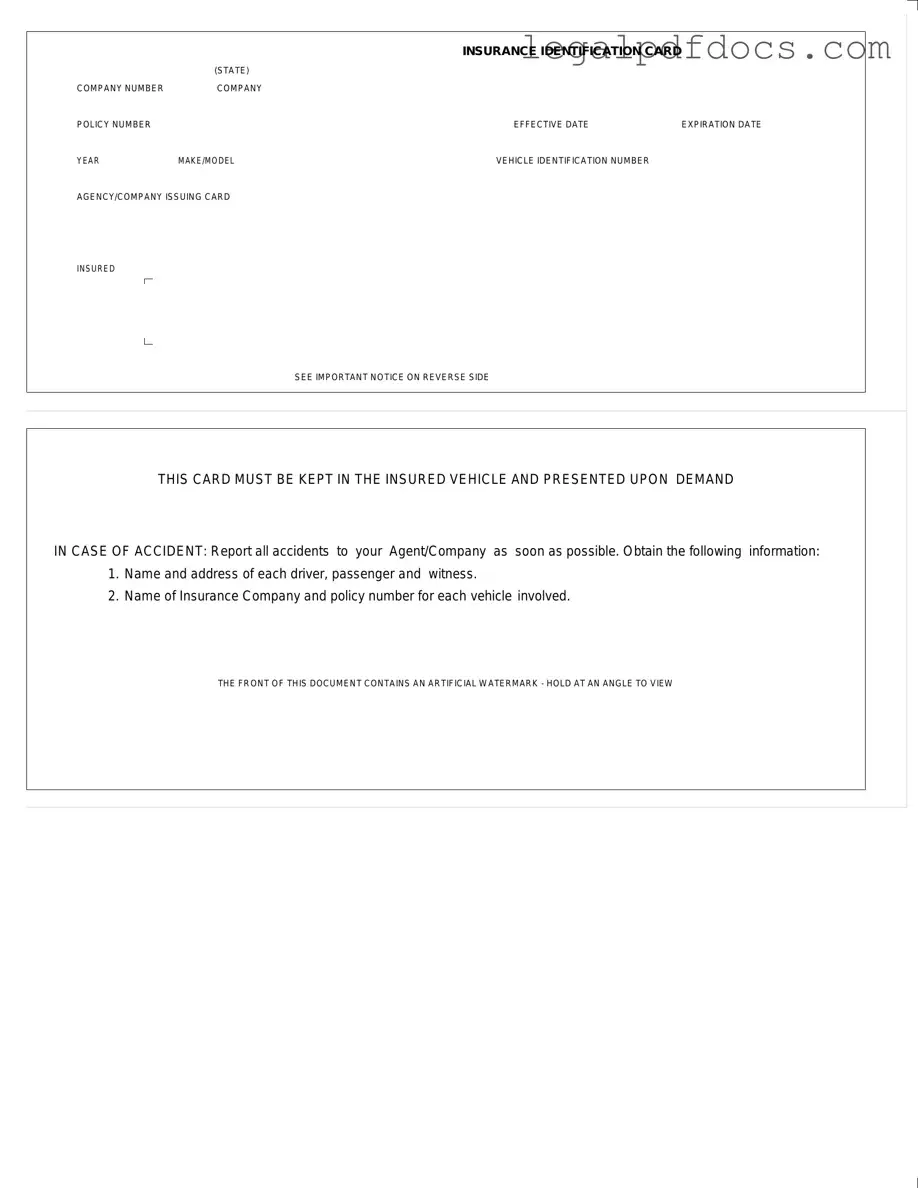

When you own a vehicle, having an Auto Insurance Card is not just a legal requirement; it is a vital document that provides proof of your insurance coverage. This card includes essential information such as the insurance company name, policy number, and effective and expiration dates, ensuring that you are protected while on the road. Additionally, it lists the make and model of your vehicle along with its Vehicle Identification Number (VIN), which helps to identify your specific car. The card is issued by your insurance agency and must be kept in the vehicle at all times. In the unfortunate event of an accident, this card serves as a crucial resource, as it needs to be presented upon request. It is also important to report any accidents to your insurance agent or company promptly, gathering necessary details such as the names and addresses of all drivers, passengers, and witnesses involved. Furthermore, the card features an artificial watermark for security purposes, which can be viewed clearly when held at an angle. Familiarizing yourself with the Auto Insurance Card form and its components can significantly ease the stress of managing your insurance needs and navigating any potential accidents.

Dos and Don'ts

When filling out the Auto Insurance Card form, there are important steps to follow. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information for each section of the form.

- Do double-check the vehicle identification number (VIN) for accuracy.

- Do keep the card in the insured vehicle at all times.

- Do report any accidents to your insurance agent as soon as possible.

- Do ensure that the effective and expiration dates are clearly marked.

- Don't leave any sections blank; fill out every required field.

- Don't use abbreviations that may confuse the information.

- Don't forget to include the name of the insurance company.

- Don't ignore the important notice on the reverse side of the card.

By following these guidelines, you can ensure that your Auto Insurance Card form is completed correctly and efficiently.

How to Use Auto Insurance Card

Filling out the Auto Insurance Card form is an important step in ensuring you have the necessary information readily available while driving. This card should be kept in your vehicle and presented if requested. Follow these steps carefully to complete the form accurately.

- Locate the form: Find the Auto Insurance Card form, which may have been provided by your insurance company.

- Fill in the company number: Write the number assigned to your insurance company in the designated space.

- Enter your policy number: Input your specific policy number as it appears on your insurance documents.

- Record the effective date: Write the date your insurance policy goes into effect.

- Fill in the expiration date: Indicate the date your insurance policy will expire.

- Provide vehicle information: Enter the year, make, and model of your vehicle in the appropriate fields.

- Input the vehicle identification number: Write the unique VIN that identifies your vehicle.

- Enter the agency/company name: Fill in the name of the agency or company that is issuing the card.

- Review your information: Double-check all entries to ensure they are correct and legible.

- Keep the card safe: Store the completed card in your vehicle, ensuring it is easily accessible.

More PDF Templates

Notice of Intent to Lien Florida Pdf - By sending this notice, contractors protect their rights under Florida law.

Pdf Puppy Health Guarantee Template - Should the buyer decide to return a puppy, it must be done within two weeks of written notification.

Documents used along the form

The Auto Insurance Card is an essential document for any vehicle owner. It serves as proof of insurance and must be kept in the vehicle at all times. Alongside this card, several other forms and documents are often used in conjunction with auto insurance. Here are a few key documents that complement the Auto Insurance Card:

- Insurance Policy Document: This document outlines the terms and conditions of your insurance coverage. It includes details about what is covered, the limits of coverage, and any exclusions. It's important to review this document to understand your rights and responsibilities as an insured driver.

- Accident Report Form: In the event of an accident, this form helps document the details of the incident. It usually requires information about the parties involved, the circumstances of the accident, and any damages incurred. Completing this form promptly can assist in the claims process.

- Claim Form: If you need to file a claim after an accident or damage to your vehicle, this form is necessary. It collects information about the incident and the damages. Submitting this form to your insurance company starts the process of receiving compensation for your losses.

- Proof of Insurance Letter: This letter is often issued by your insurance company as an alternative proof of coverage. It can be useful in situations where you may not have your Auto Insurance Card on hand, such as during a traffic stop or when renting a vehicle.

Having these documents organized and readily available can make a significant difference in managing your auto insurance needs. Always keep them in a safe place, and ensure you understand their contents to navigate any situations that may arise on the road.

Misconceptions

Misconceptions about the Auto Insurance Card can lead to confusion and potentially costly mistakes. Here are five common misunderstandings:

- It is not necessary to carry the card in the vehicle. Many people believe they can keep the card at home. However, the card must be kept in the insured vehicle and presented upon demand in case of an accident.

- The card does not need to be updated regularly. Some assume that once they receive their card, it remains valid indefinitely. In reality, the card must reflect the current policy number and effective dates, which can change with renewals.

- All information on the card is optional. Individuals might think they can ignore certain fields. Every section, including the vehicle identification number and policy number, is crucial for accurate identification and claims processing.

- Only the driver needs to know about the card. This is a common belief, but all passengers should be aware of the card's existence. In an accident, having access to this information can expedite the reporting process.

- The watermark is just for decoration. Some may overlook the watermark thinking it has no purpose. In fact, it serves as a security feature. Hold the card at an angle to view the watermark clearly, confirming its authenticity.

File Specs

| Fact Name | Description |

|---|---|

| Insurance Identification Card | This card serves as proof of auto insurance coverage for the insured vehicle. |

| Company Number | The unique identifier assigned to the insurance company providing the policy. |

| Policy Number | This number identifies the specific insurance policy for the vehicle. |

| Effective Date | The date when the insurance coverage begins. |

| Expiration Date | The date when the insurance coverage ends and renewal is required. |

| Vehicle Information | Includes the year, make, model, and vehicle identification number (VIN) of the insured vehicle. |

| Issuing Agency/Company | The name of the agency or company that issued the insurance card. |

| Legal Requirement | Most states require this card to be kept in the insured vehicle and presented upon request during an accident. |

Key takeaways

When filling out and using the Auto Insurance Card form, consider the following key takeaways:

- Keep it accessible: Always store the insurance card in the insured vehicle. This ensures that it is readily available when needed.

- Provide accurate details: Double-check all information, including the company number, policy number, and vehicle identification number, to avoid any discrepancies.

- Understand the importance: This card must be presented upon demand in case of an accident, so having it on hand is crucial.

- Report accidents promptly: In the event of an accident, report it to your insurance agent or company as soon as possible to initiate the claims process.

- Gather necessary information: After an accident, collect the names and addresses of all drivers, passengers, and witnesses involved, as well as the insurance details for each vehicle.

- Recognize the watermark: The front of the card features an artificial watermark. Hold it at an angle to view this security feature clearly.