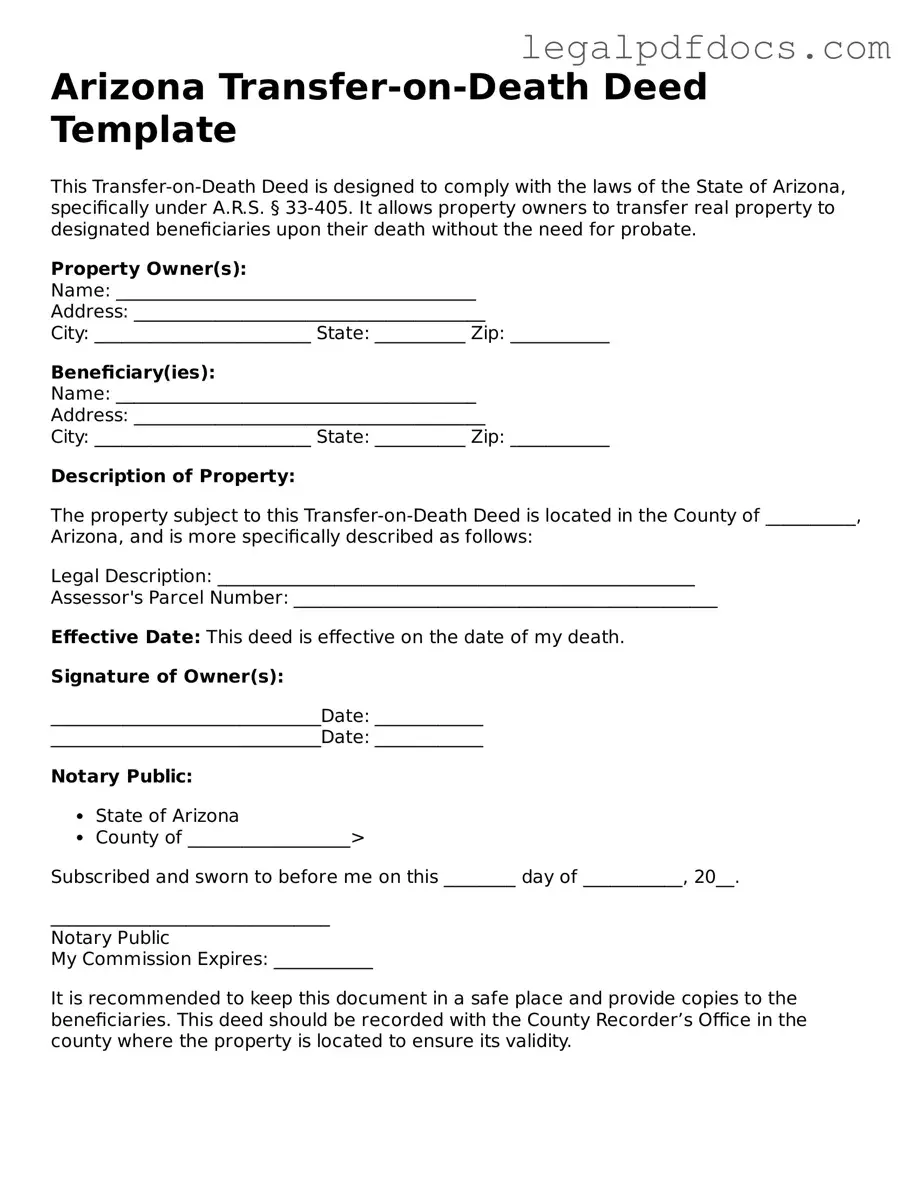

Official Transfer-on-Death Deed Form for Arizona

The Arizona Transfer-on-Death Deed (TOD) form provides a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the lengthy and often costly probate process. This form allows individuals to maintain full control of their property during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their assets as they see fit. Upon the death of the property owner, the designated beneficiaries automatically receive ownership without the need for court intervention. The TOD deed must be properly executed and recorded with the county recorder's office to be valid, which includes the signatures of the property owner and a witness. Importantly, property owners can revoke or change the beneficiaries at any time before their passing, providing flexibility in estate planning. Understanding the nuances of this form can empower individuals to make informed decisions about their property and legacy.

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it's essential to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do ensure that the form is filled out completely and accurately.

- Do include the legal description of the property, not just the address.

- Do sign the deed in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't forget to check for any state-specific requirements before submitting the form.

- Don't leave any blanks on the form, as this can lead to complications later.

How to Use Arizona Transfer-on-Death Deed

Once you have the Arizona Transfer-on-Death Deed form, it’s time to fill it out. This form allows you to designate a beneficiary who will receive your property upon your passing. Follow the steps below to ensure the form is completed correctly.

- Begin by entering your name and address at the top of the form. Make sure this information is accurate.

- Next, provide the legal description of the property you wish to transfer. You can find this information on your property deed or tax records.

- Indicate the name of the beneficiary. This should be the person who will inherit the property.

- Include the beneficiary’s address. This is important for record-keeping purposes.

- Sign and date the form. Your signature must be dated to validate the deed.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Finally, file the completed form with the county recorder’s office in the county where the property is located. This step is essential for the deed to be effective.

Find Popular Transfer-on-Death Deed Forms for US States

Tod Deed California - You can use this deed for various types of real property, such as homes, land, or commercial buildings.

Illinois Transfer on Death Instrument - A Transfer-on-Death Deed is often more cost-effective than a will for property transfers.

Does a Transfer on Death Deed Supersede a Will - It may also be advantageous for parents who wish to transfer property to their children without immediate tax implications.

Documents used along the form

The Arizona Transfer-on-Death Deed is a useful tool for estate planning, allowing property owners to transfer their real estate to beneficiaries without going through probate. However, several other documents and forms are often used in conjunction with this deed to ensure a smooth transfer process and to address various aspects of estate management. Below is a list of these forms and documents.

- This document outlines how a person's assets should be distributed upon their death, including any specific bequests or instructions for guardianship of minor children.

- A legal arrangement that allows a person to place assets into a trust during their lifetime, which can then be managed for their benefit and distributed to beneficiaries upon their death without probate.

- A sworn statement confirming the death of an individual, often required to update property titles and remove the deceased from ownership records.

- These forms are used to name beneficiaries for certain accounts or policies, such as life insurance or retirement accounts, ensuring those assets pass directly to the named individuals.

- A document that grants someone the authority to make decisions on another person's behalf, particularly useful if the property owner becomes incapacitated.

- This is a security instrument used in real estate transactions, where a borrower conveys property to a trustee as security for a loan, ensuring the lender's interests are protected.

- A policy that protects property owners and lenders from financial loss due to defects in the title, such as liens or claims against the property.

- Documents that provide information about property taxes owed, which are essential for maintaining compliance and ensuring that the property remains in good standing.

- A comprehensive list of all assets owned by a deceased person, which helps in the distribution process and ensures all assets are accounted for.

- Various documents that may need to be submitted to the court if the estate goes through probate, including petitions and notices to beneficiaries.

Using these documents alongside the Arizona Transfer-on-Death Deed can help streamline the estate planning process and ensure that your wishes are carried out effectively. It is advisable to consult with an estate planning professional to determine the best approach for your specific situation.

Misconceptions

Understanding the Arizona Transfer-on-Death Deed (TOD) can help individuals make informed decisions about their estate planning. However, several misconceptions can lead to confusion. Here are nine common myths about the TOD form:

- The Transfer-on-Death Deed is only for wealthy individuals. Many people believe that only those with significant assets can benefit from a TOD. In reality, this deed is accessible to anyone who owns real property, regardless of their financial status.

- A TOD deed avoids probate entirely. While a TOD deed allows for the transfer of property outside of probate, it does not eliminate the need for probate in all circumstances. Other assets may still require probate, depending on the overall estate.

- The property automatically transfers upon death. A common misconception is that the property transfers immediately upon death. In truth, the beneficiary must file the deed with the county recorder's office after the owner's death for the transfer to take effect.

- You cannot change or revoke a TOD deed. Many believe that once a TOD deed is executed, it cannot be altered. However, the owner can revoke or change the deed at any time before their death, as long as they follow the proper procedures.

- A TOD deed is the same as a will. Some people think that a TOD deed functions like a will. While both documents relate to the transfer of property, a TOD deed specifically addresses real estate and avoids probate, whereas a will covers all assets and requires probate.

- The TOD deed is only effective if there are no debts. There's a misconception that a TOD deed is only valid if the property owner has no outstanding debts. In reality, debts do not invalidate the deed, but they may affect the estate's overall value and how assets are distributed.

- All heirs must agree to the TOD deed. Some believe that all potential heirs must consent to a TOD deed. However, the property owner has the right to designate beneficiaries without needing approval from others.

- A TOD deed can only name one beneficiary. Many think that a TOD deed can only designate a single beneficiary. In fact, property owners can name multiple beneficiaries, allowing for shared ownership if desired.

- Once filed, the TOD deed is permanent. A common belief is that once a TOD deed is recorded, it remains in effect forever. However, if the property owner sells or transfers the property, the TOD deed becomes void.

By dispelling these misconceptions, individuals can better navigate the complexities of estate planning in Arizona.

PDF Specifications

| Fact Name | Description |

|---|---|

| What is a Transfer-on-Death Deed? | A Transfer-on-Death Deed allows property owners in Arizona to transfer their real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in Arizona is governed by Arizona Revised Statutes § 33-405. |

| Eligibility | Any individual who owns real property in Arizona can create a Transfer-on-Death Deed, provided they are of sound mind. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death by executing a new deed or by recording a revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be named, and property can be divided among them in specified percentages. |

| Recording Requirements | The deed must be recorded with the county recorder’s office in the county where the property is located to be effective. |

| Impact on Creditors | Transfer-on-Death Deeds do not shield the property from creditors. Debts owed by the deceased may still be claimed against the estate. |

Key takeaways

Filling out and using the Arizona Transfer-on-Death Deed form can be a straightforward process, but it’s essential to understand the key aspects to ensure it’s done correctly. Here are some important takeaways:

- Purpose of the Deed: The Transfer-on-Death Deed allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding probate.

- Eligibility: Any individual who owns real property in Arizona can create a Transfer-on-Death Deed, provided they are of sound mind and at least 18 years old.

- Filling Out the Form: The form must include the legal description of the property and the names of the beneficiaries. Ensure all information is accurate to prevent future disputes.

- Signing Requirements: The deed must be signed by the property owner in front of a notary public. This step is crucial for the document's validity.

- Recording the Deed: After completing the form, it must be recorded with the county recorder's office where the property is located. This step makes the deed effective and legally binding.

- Revoking the Deed: The property owner can revoke the Transfer-on-Death Deed at any time before their death by filing a new deed or a revocation form with the county recorder.

Understanding these key points can simplify the process and help ensure that your property is transferred according to your wishes. Always consider consulting with a legal professional for personalized guidance.