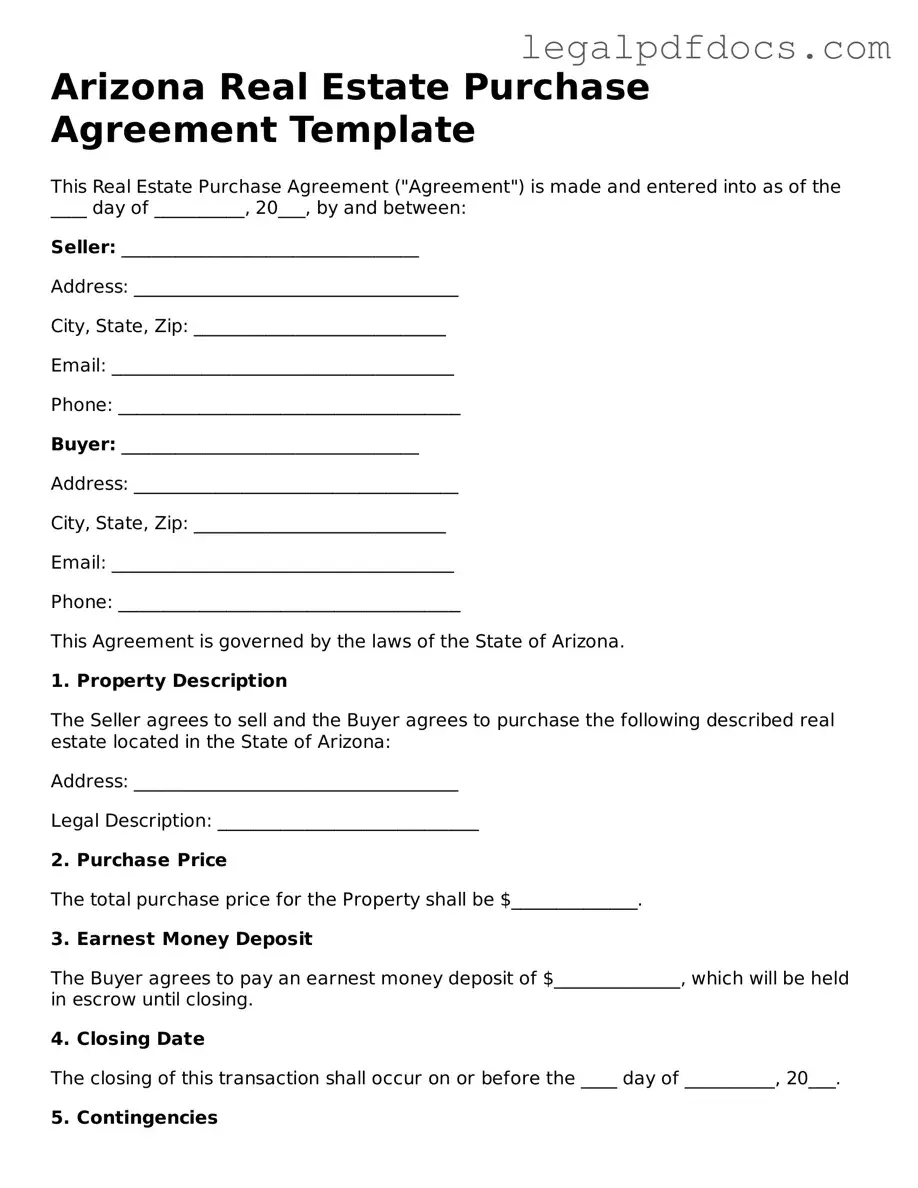

Official Real Estate Purchase Agreement Form for Arizona

The Arizona Real Estate Purchase Agreement form serves as a crucial document in the home-buying process, outlining the terms and conditions agreed upon by the buyer and seller. This form addresses key components such as the purchase price, the property description, and the closing date, ensuring both parties have a clear understanding of their obligations. It also includes provisions for earnest money deposits, contingencies related to financing or inspections, and any additional terms that may be specific to the transaction. Furthermore, the agreement typically covers the allocation of closing costs, the responsibilities for repairs, and the timeline for completing the sale. By clearly detailing these elements, the Arizona Real Estate Purchase Agreement promotes transparency and helps mitigate potential disputes, making it an essential tool for anyone involved in real estate transactions in the state.

Dos and Don'ts

When filling out the Arizona Real Estate Purchase Agreement form, it's important to be careful and thorough. Here are some things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do provide accurate information about the property and parties involved.

- Do consult with a real estate agent or attorney if you have questions.

- Do ensure all necessary signatures are included.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the process; take your time to avoid mistakes.

How to Use Arizona Real Estate Purchase Agreement

Once you have the Arizona Real Estate Purchase Agreement form in front of you, it is important to complete it accurately to facilitate the transaction process. Follow these steps to ensure that all necessary information is included.

- Begin by entering the date at the top of the form.

- Fill in the names of the buyer(s) and seller(s) in the designated sections.

- Provide the property address, including city, state, and zip code.

- Specify the purchase price of the property in the appropriate field.

- Indicate the amount of the earnest money deposit and the method of payment.

- Complete the financing section, detailing whether the buyer will use a loan or pay cash.

- Fill in any contingencies that apply to the sale, such as inspections or financing approval.

- Include any additional terms or conditions that both parties agree upon.

- Sign and date the agreement at the bottom of the form.

- Ensure that all parties receive a copy of the completed form for their records.

Find Popular Real Estate Purchase Agreement Forms for US States

Purchasing Agreements - Sets forth the timeline for closing the sale and transferring ownership.

Purchase Agreement Michigan for Sale by Owner - Identifies third-party involvement, such as realtors or attorneys, if any.

Documents used along the form

When engaging in a real estate transaction in Arizona, several important documents often accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring that the process is smooth and legally sound. Here’s a list of commonly used forms and documents:

- Seller's Disclosure Statement: This document provides potential buyers with information about the property's condition and any known issues. It helps buyers make informed decisions.

- Counteroffer: If the seller does not accept the initial offer, they may issue a counteroffer. This document outlines the new terms and conditions for the sale.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint and its hazards.

- Title Report: This document shows the history of ownership and any liens or encumbrances on the property. It ensures that the title is clear for the buyer.

- Closing Statement: Also known as a HUD-1 statement, this document details all the financial aspects of the transaction, including costs and fees for both the buyer and seller.

- Home Warranty Agreement: This optional agreement provides coverage for repairs or replacements of home systems and appliances, offering peace of mind to the buyer.

- Escrow Agreement: This document outlines the terms under which the escrow agent will hold funds and documents until the transaction is completed.

- Affidavit of Title: A sworn statement by the seller affirming their ownership of the property and that there are no undisclosed liens or claims against it.

Understanding these documents is essential for anyone involved in a real estate transaction in Arizona. Each form serves a specific purpose and helps protect the interests of both buyers and sellers. Being well-informed can lead to a more successful and less stressful experience.

Misconceptions

- Misconception 1: The Arizona Real Estate Purchase Agreement is a standard template that can be used without modifications.

- Misconception 2: Only real estate agents can fill out the Purchase Agreement.

- Misconception 3: Once signed, the Purchase Agreement cannot be changed.

- Misconception 4: The Purchase Agreement guarantees a successful closing.

- Misconception 5: All contingencies are automatically included in the Purchase Agreement.

- Misconception 6: The Purchase Agreement is only for residential properties.

- Misconception 7: The Purchase Agreement is a legally binding contract as soon as it is signed.

- Misconception 8: The Purchase Agreement does not require legal review.

- Misconception 9: The Purchase Agreement is the only document needed for a real estate transaction.

While there are common elements in many agreements, each transaction is unique. Customizing the agreement to reflect specific terms and conditions is essential for both parties.

Homebuyers and sellers can certainly fill out the agreement themselves. However, consulting with a legal professional is advisable to ensure all terms are clear and enforceable.

Parties can amend the agreement if both agree to the changes. It’s important to document any modifications in writing to maintain clarity.

The agreement outlines the terms, but it does not guarantee that the sale will close. Factors such as financing and inspections can affect the outcome.

Contingencies, such as financing or inspection conditions, must be explicitly stated in the agreement. Parties should ensure they include all relevant contingencies to protect their interests.

This form can be used for various types of real estate transactions, including commercial properties. Specific terms may vary based on the property type.

While signing indicates intent, the agreement may not be binding until all contingencies are satisfied and any required deposits are made.

Having a legal professional review the agreement is a wise step. This ensures that all terms are understood and that the agreement is compliant with local laws.

In addition to the Purchase Agreement, other documents such as disclosures, title reports, and financing agreements are often necessary to complete the transaction.

PDF Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The Arizona Real Estate Purchase Agreement is governed by Arizona state law. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Offer and Acceptance | The agreement serves as a formal offer from the buyer, which the seller can accept, reject, or counter. |

| Deposit Requirement | Typically, a deposit is required from the buyer to demonstrate serious intent to purchase. |

| Contingencies | Common contingencies include home inspections, financing, and appraisal conditions. |

| Closing Date | The agreement specifies a closing date, which is the day the ownership of the property is officially transferred. |

| Disclosures | Sellers are required to disclose any known issues with the property that could affect its value or safety. |

| Legal Review | It is advisable for both parties to have the agreement reviewed by a legal professional before signing. |

Key takeaways

Understand the purpose of the Arizona Real Estate Purchase Agreement. This document serves as a legally binding contract between the buyer and seller, outlining the terms of the sale.

Fill in all required fields accurately. Missing information can lead to delays or disputes. Double-check names, addresses, and property details.

Be aware of contingencies. These are conditions that must be met for the sale to proceed. Common contingencies include financing, inspections, and appraisals.

Review the closing timeline. The agreement should specify when the closing will occur, as well as any deadlines for contingencies and other important actions.

Consider including an earnest money deposit. This shows the seller that the buyer is serious and can help secure the agreement.

Understand the implications of the inspection clause. Buyers typically have the right to conduct inspections and negotiate repairs based on findings.

Consult with a real estate professional or attorney. Their expertise can help clarify any confusing terms and ensure that all legal requirements are met.