Official Operating Agreement Form for Arizona

When forming a limited liability company (LLC) in Arizona, one of the key documents you'll encounter is the Operating Agreement. This essential form serves as the backbone of your business structure, outlining the roles and responsibilities of members, the management framework, and the operational procedures that will guide your LLC's daily functions. While Arizona law does not mandate an Operating Agreement, having one in place is highly advisable as it helps to clarify the ownership stakes and decision-making processes among members. This document typically includes provisions regarding profit distribution, member contributions, and procedures for adding or removing members. Additionally, it addresses how disputes will be resolved, ensuring that all parties are on the same page. By laying out these critical elements, the Operating Agreement not only protects individual interests but also fosters a collaborative environment for business growth and success.

Dos and Don'ts

When filling out the Arizona Operating Agreement form, it's important to approach the task with care. Here are ten essential do's and don'ts to keep in mind:

- Do ensure that all members are identified clearly, including their roles and responsibilities.

- Don't leave any sections blank. Incomplete forms can lead to delays or issues later.

- Do specify the management structure of the LLC, whether it’s member-managed or manager-managed.

- Don't overlook the importance of including provisions for profit and loss distribution.

- Do outline the process for adding or removing members from the LLC.

- Don't forget to include a dispute resolution process to handle potential conflicts.

- Do review the document for accuracy before submitting it.

- Don't use vague language; clarity is key to avoid misunderstandings.

- Do consult with a legal professional if you have questions about specific provisions.

- Don't rush the process. Take your time to ensure everything is done correctly.

Following these guidelines can help ensure that your Arizona Operating Agreement is completed accurately and effectively, setting a solid foundation for your LLC.

How to Use Arizona Operating Agreement

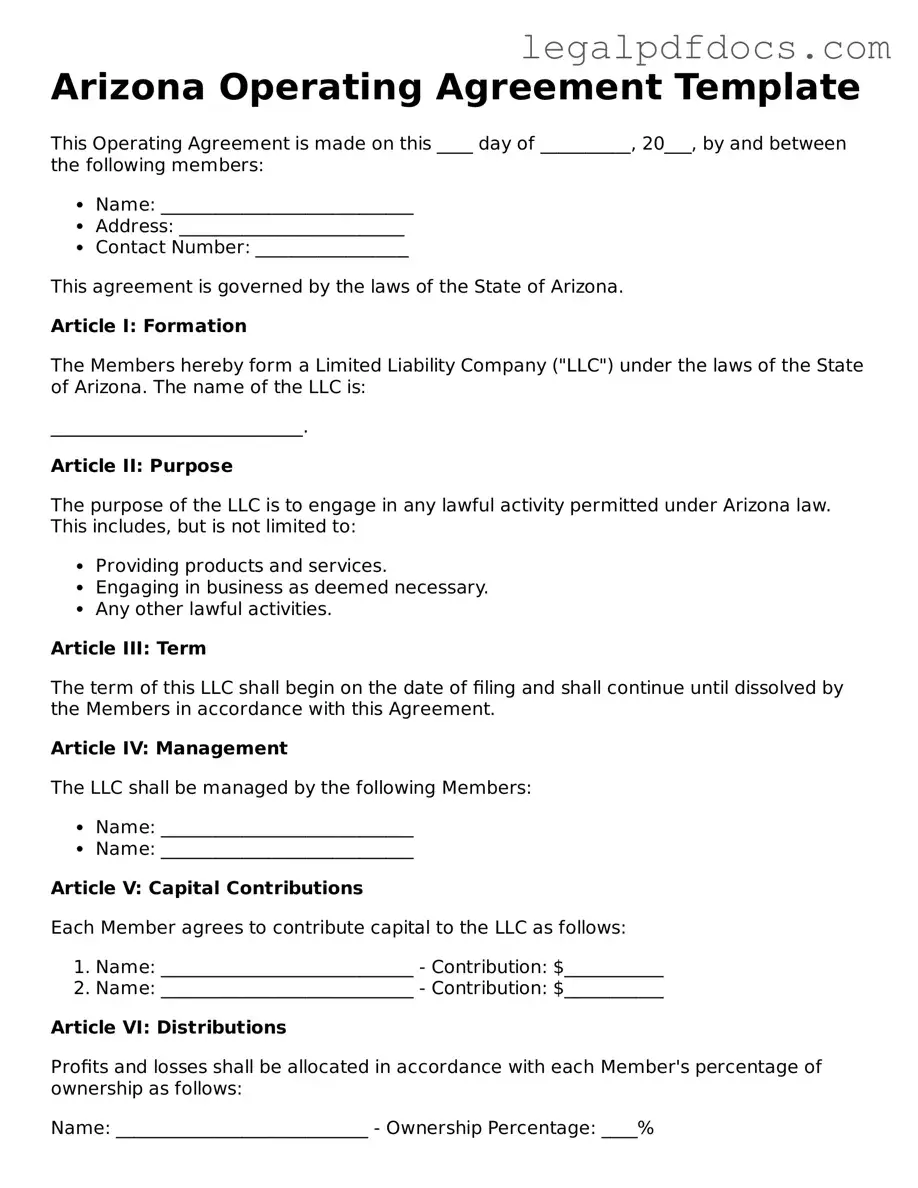

Filling out the Arizona Operating Agreement form is a straightforward process that requires careful attention to detail. This document is essential for outlining the management structure and operational procedures of your business. Follow these steps to ensure accurate completion.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal address of the business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Ensure that each member's information is correct and complete.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail the capital contributions made by each member. Include the amount and type of contribution (cash, property, etc.).

- Outline the profit and loss distribution among the members. Clearly state how profits and losses will be shared.

- Include any additional provisions that are relevant to your LLC. This can cover voting rights, decision-making processes, or any other specific rules.

- Review the completed form for accuracy. Make sure all information is correct and legible.

- Sign and date the form. Ensure that all members also sign where required.

Once the form is filled out and signed, it should be kept with your business records. This document will serve as a reference for the management and operations of your LLC moving forward.

Find Popular Operating Agreement Forms for US States

Idaho Llc Operating Agreement - This form can specify what happens in case of a member's death or incapacity.

How to Set Up an Operating Agreement for Llc - The agreement is crucial for small businesses seeking investor confidence.

Documents used along the form

When forming a limited liability company (LLC) in Arizona, several documents are typically used alongside the Arizona Operating Agreement. Each document serves a specific purpose in the formation and management of the LLC. Below is a list of common forms and documents that may be required or beneficial.

- Articles of Organization: This document is filed with the Arizona Corporation Commission to officially create the LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover various topics, including the approval of major business decisions.

- Operating Procedures: This document outlines the day-to-day operational procedures of the LLC. It can include policies on meetings, financial management, and member responsibilities.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They typically include the member's name, the percentage of ownership, and other relevant details.

- Bylaws: While not always required, bylaws can provide additional governance rules for the LLC. They may cover topics such as member voting rights and the process for electing managers.

- Tax Identification Number (EIN) Application: An EIN is necessary for tax purposes. This document is submitted to the IRS to obtain a unique identification number for the LLC.

- Initial Meeting Minutes: These minutes document the discussions and decisions made during the first meeting of the LLC members. They help establish a record of the formation process.

- Bank Resolution: This document authorizes specific individuals to open and manage the LLC's bank account. It is often required by banks when setting up the account.

- State and Local Business Licenses: Depending on the nature of the business, various licenses may be required at the state or local level. These ensure compliance with regulations governing the business.

- Operating Agreement Amendments: If changes need to be made to the original Operating Agreement, amendments document those changes. They must be agreed upon by the members of the LLC.

These documents work together to provide a comprehensive framework for the operation and management of an LLC in Arizona. Properly preparing and maintaining these forms can help ensure compliance with state laws and facilitate smooth business operations.

Misconceptions

Understanding the Arizona Operating Agreement form is essential for anyone involved in a limited liability company (LLC) in the state. However, several misconceptions can lead to confusion. Below are eight common misconceptions about the Arizona Operating Agreement form, along with clarifications to help dispel these myths.

- Misconception 1: The Operating Agreement is optional for Arizona LLCs.

- Misconception 2: The Operating Agreement must be filed with the state.

- Misconception 3: All members must sign the Operating Agreement.

- Misconception 4: The Operating Agreement can only be amended through a formal process.

- Misconception 5: The Operating Agreement is only for multi-member LLCs.

- Misconception 6: The Operating Agreement can only address financial matters.

- Misconception 7: An Operating Agreement is a one-time document that does not require updates.

- Misconception 8: The Operating Agreement does not have legal standing.

While it is true that Arizona does not legally require LLCs to have an Operating Agreement, it is highly advisable to create one. This document outlines the management structure and operational procedures, which can prevent disputes among members.

The Operating Agreement does not need to be filed with the Arizona Corporation Commission. It is an internal document that should be kept with the LLC’s records.

While it is beneficial for all members to sign the Operating Agreement to signify their agreement, it is not a legal requirement. However, having all members' signatures can help avoid future disputes.

Amendments to the Operating Agreement can often be made informally, as long as all members agree. It is wise to document any changes to maintain clarity.

Even single-member LLCs benefit from having an Operating Agreement. It helps establish the business as a separate entity and clarifies the owner’s intentions regarding management and operations.

The Operating Agreement can cover a wide range of topics, including management structure, member roles, decision-making processes, and procedures for adding new members. It is a comprehensive document that can guide many aspects of the LLC's operation.

As the business evolves, the Operating Agreement should be reviewed and updated regularly to reflect changes in membership, management, or business goals.

The Operating Agreement is a legally binding document among members of the LLC. Courts generally uphold its terms, provided they do not violate state laws.

By addressing these misconceptions, individuals can better understand the importance of the Arizona Operating Agreement form and its role in the effective management of an LLC.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Operating Agreement outlines the management structure and operating procedures for an LLC. |

| Governing Law | Arizona Revised Statutes, Title 29, Chapter 3 governs the formation and operation of LLCs in Arizona. |

| Members | All members of the LLC can be included in the Operating Agreement, detailing their rights and responsibilities. |

| Flexibility | The agreement allows for flexibility in management, permitting members to choose between member-managed or manager-managed structures. |

| Dispute Resolution | Provisions for resolving disputes can be included, helping to avoid lengthy litigation. |

| Amendments | The Operating Agreement can be amended as needed, allowing the LLC to adapt to changing circumstances. |

| Confidentiality | It can include confidentiality clauses to protect sensitive information shared among members. |

| Tax Treatment | The agreement can specify how the LLC will be taxed, influencing financial outcomes for members. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended to provide clarity and structure. |

Key takeaways

When filling out and using the Arizona Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational guidelines for your LLC. It serves as a crucial document for both internal governance and external relations.

- Include Essential Details: Be sure to specify the names of the members, their contributions, and the percentage of ownership. This clarity helps prevent disputes among members.

- Define Management Structure: Decide whether your LLC will be member-managed or manager-managed. Clearly outline the roles and responsibilities of each member or manager.

- Establish Voting Rights: Specify how decisions will be made within the LLC. Determine voting rights and the process for making important decisions.

- Address Profit and Loss Distribution: Clearly outline how profits and losses will be allocated among members. This can help avoid misunderstandings in the future.

- Review and Update Regularly: An Operating Agreement is not a static document. Regularly review and update it to reflect any changes in membership or business operations.