Official Deed Form for Arizona

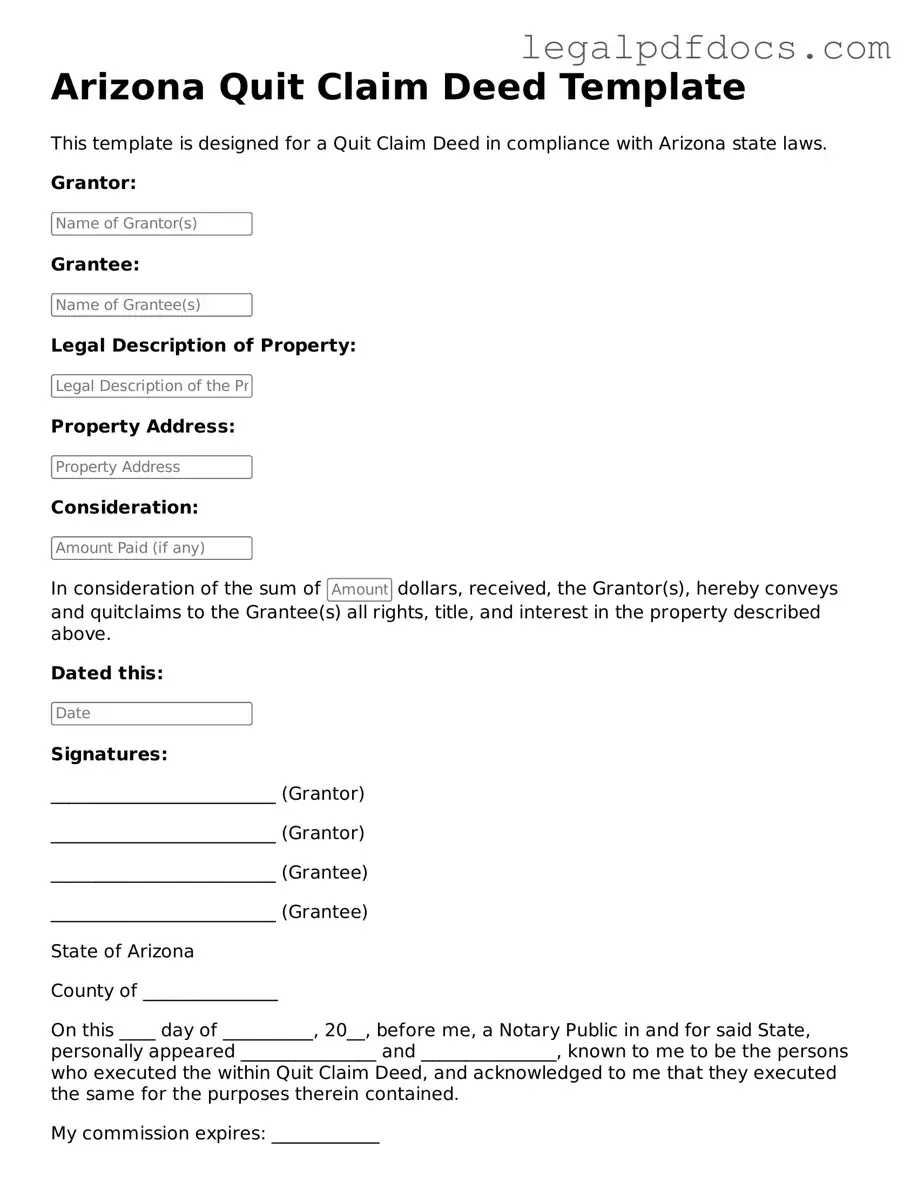

The Arizona Deed form is a crucial document in real estate transactions, serving as the legal instrument that transfers property ownership from one party to another. This form encompasses various essential elements, including the names of the grantor and grantee, a detailed description of the property, and the terms of the transfer. It is important to note that different types of deeds, such as warranty deeds and quitclaim deeds, serve distinct purposes and provide varying levels of protection for the buyer. Additionally, the form must be signed, notarized, and recorded with the county recorder’s office to ensure its validity and to provide public notice of the ownership change. Understanding the intricacies of the Arizona Deed form is vital for both buyers and sellers, as it helps to prevent disputes and ensures a smooth transaction process.

Dos and Don'ts

When filling out the Arizona Deed form, attention to detail is crucial. Here are some important dos and don'ts to consider:

- Do ensure that all names are spelled correctly. Mistakes can lead to complications in property ownership.

- Do provide a complete and accurate description of the property. This includes the address and legal description.

- Do sign the form in front of a notary public. This step is essential for the document's validity.

- Do check local requirements. Different counties may have specific rules regarding the filing of deeds.

- Don't leave any sections blank. Incomplete forms can be rejected or cause delays in processing.

- Don't forget to include any required fees. Payment details should be clear to avoid issues during submission.

How to Use Arizona Deed

After obtaining the Arizona Deed form, the next step is to carefully fill it out to ensure that all necessary information is accurately provided. This process is essential for the proper transfer of property ownership. Below are the steps to complete the form.

- Begin by entering the current date at the top of the form.

- In the first section, write the name of the grantor, the person transferring the property. Include their address and contact information.

- Next, list the name of the grantee, the person receiving the property. Again, provide their address and contact information.

- In the description section, provide a detailed description of the property being transferred. This includes the address and any relevant parcel or lot numbers.

- Indicate the type of deed you are using. Common types include warranty deeds or quitclaim deeds. Choose the appropriate one based on your situation.

- Include any additional terms or conditions of the transfer, if applicable. This might involve specific agreements between the grantor and grantee.

- Both the grantor and grantee should sign and date the form in the designated areas. Make sure to have the signatures notarized to validate the document.

- Finally, submit the completed deed to the appropriate county recorder's office for official recording. Check for any required fees associated with this process.

Find Popular Deed Forms for US States

How Does House Title Look Like - Establishes the new owner of a property.

Property Deed Form - The deed can be used in various types of real estate transactions.

Documents used along the form

When engaging in property transactions in Arizona, various forms and documents often accompany the Arizona Deed form. Each of these documents serves a specific purpose, ensuring that the transfer of property is legally sound and properly recorded. Understanding these forms can help streamline the process and protect the interests of all parties involved.

- Title Insurance Policy: This document protects the buyer against any future claims or disputes over property ownership. It ensures that the title is clear and that the buyer has a legitimate claim to the property.

- Property Disclosure Statement: Sellers typically provide this form to inform buyers of any known issues with the property, such as structural problems or environmental hazards. Transparency helps build trust in the transaction.

- Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, contingencies, and closing date. It serves as a binding agreement between the buyer and seller.

- Affidavit of Value: Required by Arizona law, this document discloses the sale price of the property to the county assessor. It helps ensure accurate property tax assessments.

- Loan Documents: If financing is involved, various loan documents will be necessary. These include the promissory note and mortgage agreement, which outline the terms of the loan and the obligations of the borrower.

- Closing Statement: This detailed document summarizes the financial aspects of the transaction, including closing costs, credits, and debits for both the buyer and seller. It is typically reviewed at the closing meeting.

- IRS Form 1099-S: This form is used to report the sale of real estate to the Internal Revenue Service. It ensures compliance with tax regulations regarding capital gains.

- Power of Attorney: If one party cannot be present at the closing, a power of attorney may be used. This legal document allows another person to act on their behalf, facilitating the completion of the transaction.

Each of these documents plays a crucial role in the property transfer process in Arizona. By familiarizing oneself with them, individuals can navigate the complexities of real estate transactions more effectively, ensuring a smoother and more secure experience.

Misconceptions

Understanding the Arizona Deed form can be challenging. Many people hold misconceptions that can lead to confusion or mistakes. Here are ten common misconceptions about the Arizona Deed form:

- All deeds are the same. Not all deeds serve the same purpose. Different types of deeds, such as warranty deeds and quitclaim deeds, have distinct legal implications.

- You don’t need a lawyer. While it is possible to complete a deed without legal assistance, consulting a lawyer can help ensure that all legal requirements are met.

- Once a deed is signed, it cannot be changed. A deed can be amended or revoked, but this process must follow specific legal procedures.

- Only the seller signs the deed. Both the seller and buyer typically need to sign the deed to make it valid.

- Deeds are only for transferring property ownership. Deeds can also be used for other purposes, such as placing property in a trust.

- Filing a deed is optional. In Arizona, filing a deed with the county recorder is necessary to make the transfer of ownership official.

- All deeds need to be notarized. While notarization is common, some types of deeds may not require it. Always check the specific requirements.

- Deeds are only relevant during a sale. Deeds can also be important for estate planning and transferring property upon death.

- You can use a generic deed form. It’s best to use a deed form specific to Arizona, as local laws may differ significantly.

- Once a deed is recorded, it cannot be contested. Even after recording, there may be grounds to contest a deed in certain situations, such as fraud or lack of capacity.

Clearing up these misconceptions can help ensure a smoother process when dealing with property transactions in Arizona.

PDF Specifications

| Fact Name | Details |

|---|---|

| Type of Deed | The Arizona Deed form is typically used for transferring real estate ownership, including warranty deeds and quitclaim deeds. |

| Governing Law | The Arizona Deed form is governed by Arizona Revised Statutes, specifically Title 33, Chapter 4, which outlines property conveyances. |

| Signature Requirements | For the deed to be valid, it must be signed by the grantor. If the grantor is a corporation, the deed must be signed by an authorized officer. |

| Notarization | Notarization is required for the deed to be recorded. This ensures the authenticity of the signatures and the intent of the parties involved. |

| Recording | The deed must be recorded with the county recorder's office in the county where the property is located to provide public notice of the transfer. |

| Tax Implications | Transfer taxes may apply when executing a deed in Arizona. It is advisable to consult with a tax professional regarding potential liabilities. |

Key takeaways

Filling out and using the Arizona Deed form can seem daunting, but understanding the key points can simplify the process. Here are some essential takeaways to keep in mind:

- Understand the Purpose: A deed is a legal document that transfers ownership of real property from one party to another.

- Identify the Parties: Clearly state the names of the grantor (seller) and grantee (buyer) to avoid any confusion.

- Property Description: Provide a complete and accurate description of the property, including its address and legal description.

- Signatures Required: Ensure that the grantor signs the deed. Depending on the type of deed, additional signatures may be needed.

- Notarization: The deed must be notarized to be legally valid. This step adds a layer of authenticity.

- Recording the Deed: After signing, the deed should be recorded with the county recorder’s office. This step protects the grantee's ownership rights.

- Check Local Laws: Familiarize yourself with any specific requirements or regulations in Arizona that may affect the deed.

- Consider Tax Implications: Be aware of potential tax consequences associated with the transfer of property, including transfer taxes.

- Seek Professional Help: If uncertain about any part of the process, consulting a legal professional can provide clarity and ensure compliance.

By keeping these points in mind, you can navigate the Arizona Deed form with confidence and ensure a smooth transfer of property ownership.