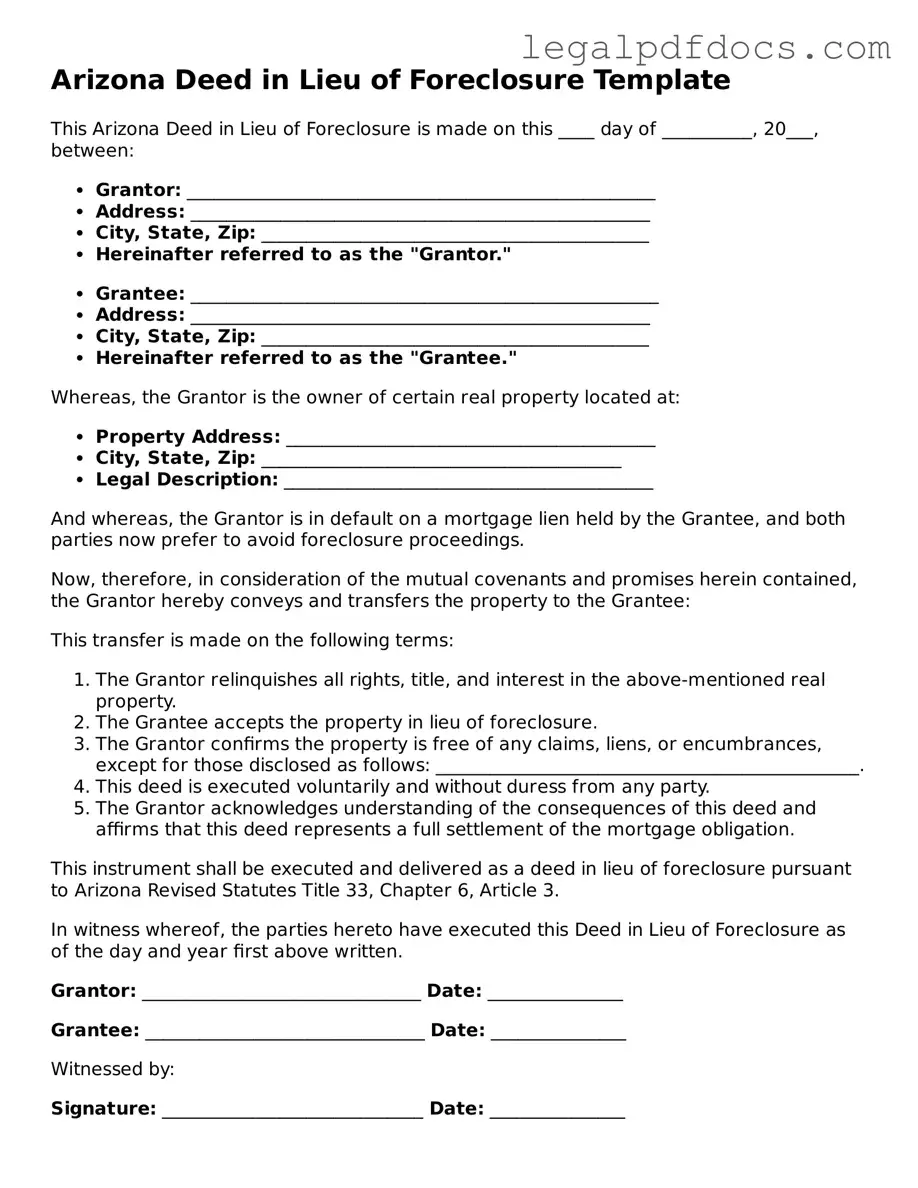

Official Deed in Lieu of Foreclosure Form for Arizona

In the realm of real estate, homeowners facing financial hardship may find themselves exploring alternatives to foreclosure. One such option is the Arizona Deed in Lieu of Foreclosure form, which serves as a legal instrument allowing a homeowner to voluntarily transfer their property back to the lender. This process can often provide a more amicable solution for both parties involved, potentially mitigating the emotional and financial toll of foreclosure. By executing this form, the homeowner relinquishes ownership of the property, while the lender agrees to cancel the mortgage debt. This arrangement can lead to a quicker resolution than traditional foreclosure proceedings, allowing the homeowner to move forward with their life. Additionally, the Deed in Lieu of Foreclosure may help protect the homeowner's credit score compared to a foreclosure, although it is essential to understand that it still may have some negative impact. In Arizona, specific requirements and implications accompany this form, making it crucial for homeowners to be informed and prepared as they navigate this challenging situation.

Dos and Don'ts

Filling out a Deed in Lieu of Foreclosure form in Arizona is a significant step that requires careful attention. To ensure a smooth process, here’s a list of dos and don’ts that can help guide you.

- Do provide accurate information about the property and the parties involved.

- Do ensure that all signatures are present and properly dated.

- Do consult with a legal professional to understand the implications of the deed.

- Do keep copies of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any fields blank; fill in all required information.

- Don't forget to check with your lender for any specific requirements.

- Don't assume that submitting the form will automatically stop foreclosure; confirm the process with your lender.

By following these guidelines, you can navigate the Deed in Lieu of Foreclosure process with greater confidence and clarity.

How to Use Arizona Deed in Lieu of Foreclosure

Once you have gathered the necessary information and documents, you can proceed to fill out the Arizona Deed in Lieu of Foreclosure form. This form is an important step in the process of transferring property ownership. It is essential to ensure that all information is accurate and complete to avoid any complications.

- Begin by entering the date at the top of the form. This should be the date you are completing the document.

- Provide the name of the current property owner(s) in the designated section. Ensure that you list all owners as they appear on the title.

- Next, enter the name of the recipient. This is typically the lender or the financial institution that holds the mortgage.

- Fill in the property address. Include the street address, city, state, and ZIP code.

- In the section for legal description, provide a complete and accurate description of the property. This may include the lot number, block number, and any other relevant details as found in the property deed.

- Indicate any existing liens or encumbrances on the property, if applicable. This helps clarify the status of the property.

- Sign the document in the designated area. Ensure that you are signing as the property owner.

- Have the signature notarized. A notary public must witness your signature to validate the document.

- Make copies of the completed and notarized form for your records and for the lender.

After completing the form, it is important to submit it to the lender along with any required supporting documents. This will initiate the process of transferring ownership and addressing the mortgage obligations. Keep a copy of everything for your records, as this will be essential for your future reference.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu of Forclosure - The agreement may include language about the handling of personal belongings post-transfer.

California Voluntary Foreclosure Deed - Homeowners should be cautious about potential tax implications stemming from the transfer of property in a Deed in Lieu situation.

Sale in Lieu of Foreclosure - Having a thorough evaluation of one's financial situation can aid in determining the suitability of this option.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu of Foreclosure is a document where the homeowner voluntarily transfers property ownership to the lender to avoid foreclosure.

Documents used along the form

A Deed in Lieu of Foreclosure is a significant step for both borrowers and lenders. It allows a borrower to transfer property ownership back to the lender, thereby avoiding the lengthy foreclosure process. When engaging in this transaction, several other forms and documents may also be necessary to ensure a smooth process. Below is a list of commonly used forms that accompany the Arizona Deed in Lieu of Foreclosure.

- Property Title Report: This document provides details about the property’s ownership history, liens, and any encumbrances that may affect the title.

- Loan Modification Agreement: If applicable, this agreement outlines changes to the original loan terms to help the borrower manage their payments better.

- Notice of Default: A formal notification to the borrower indicating that they are in default on their mortgage payments, often a precursor to foreclosure.

- Release of Liability: This document releases the borrower from any further obligation on the mortgage after the deed transfer, protecting them from future claims.

- Affidavit of Title: A sworn statement by the borrower affirming their ownership of the property and disclosing any issues that could affect the title.

- Settlement Statement: A detailed account of the financial aspects of the transaction, including any costs or fees associated with the deed transfer.

- Deed of Trust: This document secures the loan with the property as collateral and may need to be canceled or modified during the process.

- Power of Attorney: If the borrower cannot be present for the transaction, this document allows someone else to act on their behalf.

- Release of Mortgage: A document that formally releases the lender's claim against the property once the deed in lieu is executed.

- Property Condition Disclosure: A statement from the borrower detailing the current condition of the property, which can affect its value and the lender's decision.

Understanding these documents can help streamline the process of executing a Deed in Lieu of Foreclosure. Each form plays a crucial role in protecting the interests of both parties involved and ensuring compliance with state regulations. Being well-prepared with the right documentation can significantly ease the transition for all involved.

Misconceptions

When facing financial difficulties, many homeowners consider a deed in lieu of foreclosure as an option. However, several misconceptions exist about this process. Here are seven common misunderstandings:

- It eliminates all debts associated with the property. A deed in lieu of foreclosure transfers ownership of the property to the lender, but it does not automatically wipe out all debts. If there are other liens or obligations, those may still need to be addressed.

- It will not affect your credit score. While a deed in lieu of foreclosure is less damaging than a full foreclosure, it will still impact your credit score negatively. Lenders may report it as a foreclosure, which can affect future borrowing.

- It is a quick and easy solution. Although it can be faster than going through a foreclosure, the process still requires paperwork and negotiations. It may take time to reach an agreement with the lender.

- All lenders accept deeds in lieu of foreclosure. Not every lender offers this option. Some may prefer to go through the foreclosure process, so it’s important to check with your specific lender.

- You can choose this option at any time. Typically, lenders will want to see that you have made efforts to resolve your financial issues before considering a deed in lieu of foreclosure. It’s not always available as a last-minute choice.

- Your property will be sold immediately. The transfer of ownership doesn’t mean the property is sold right away. The lender may hold onto the property for some time before deciding how to proceed.

- It absolves you of all future liability. If the property sells for less than what is owed, you may still be liable for the difference unless the lender agrees to forgive that debt.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The Arizona Deed in Lieu of Foreclosure is governed by Arizona Revised Statutes, specifically under Title 33, Chapter 6. |

| Eligibility | Borrowers must demonstrate financial hardship and inability to continue mortgage payments to qualify for a Deed in Lieu of Foreclosure. |

| Process | The borrower must submit a request to the lender, who will then evaluate the situation and may accept the deed if conditions are met. |

| Impact on Credit | A Deed in Lieu of Foreclosure may negatively affect the borrower's credit score, though typically less than a foreclosure. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before executing a Deed in Lieu of Foreclosure to understand the implications fully. |

Key takeaways

Filling out and using the Arizona Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing financial difficulties. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form allows a homeowner to voluntarily transfer their property back to the lender to avoid foreclosure.

- Eligibility Requirements: Ensure you meet the lender's requirements. Typically, the borrower must be in default on their mortgage.

- Consult a Professional: It's advisable to seek legal or financial advice before proceeding to understand all implications.

- Complete the Form Accurately: Fill out the form with correct information to prevent delays or complications in the process.

- Review the Mortgage Terms: Check your mortgage agreement to ensure you are aware of any specific conditions related to the deed in lieu.

- Communicate with Your Lender: Maintain open communication with your lender throughout the process to ensure they accept the deed in lieu.

- Consider Tax Implications: Understand that there may be tax consequences associated with transferring your property in this manner.

- Obtain a Release of Liability: Ensure that the deed in lieu includes a release from any further liability on the mortgage debt.

- Document Everything: Keep copies of all documents and correspondence related to the deed in lieu for your records.

Taking these steps can help streamline the process and provide a clearer path forward during a challenging time.