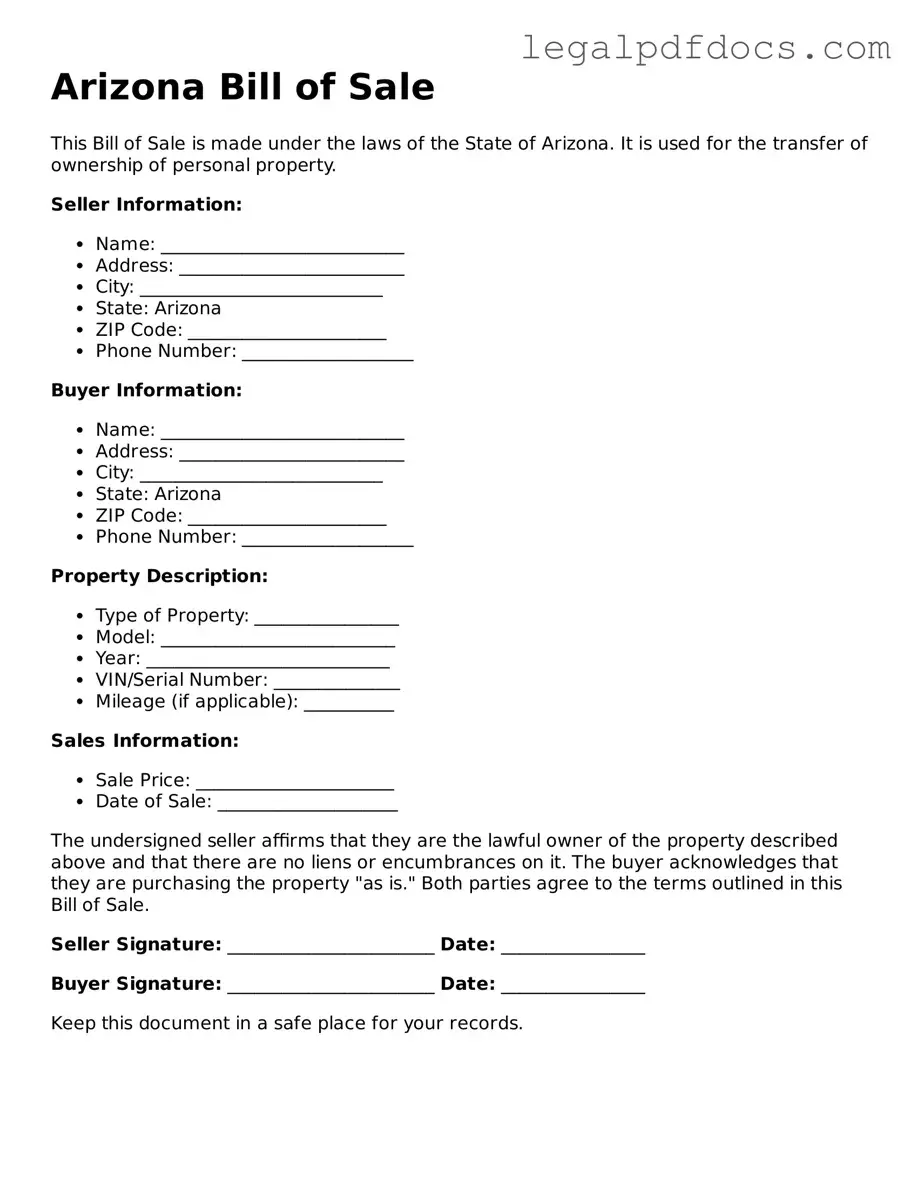

Official Bill of Sale Form for Arizona

The Arizona Bill of Sale form serves as a crucial document in the transfer of ownership for personal property, providing both buyers and sellers with a clear record of the transaction. This form typically includes essential details such as the names and addresses of both parties, a description of the item being sold, and the sale price. Additionally, it may encompass information about the condition of the item, any warranties or guarantees, and the date of the transaction. By documenting these elements, the Bill of Sale not only facilitates a smooth exchange but also protects the rights of both parties involved. In Arizona, this form can be particularly important for transactions involving vehicles, boats, or other significant assets, as it often serves as proof of ownership and may be required for registration or titling purposes. Understanding the components and significance of the Arizona Bill of Sale is vital for anyone engaging in a sale, ensuring that both parties are aware of their rights and obligations throughout the process.

Dos and Don'ts

When filling out the Arizona Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Here are five things to do and avoid.

- Do: Provide accurate information about the buyer and seller, including full names and addresses.

- Do: Include a detailed description of the item being sold, including make, model, year, and VIN if applicable.

- Do: Clearly state the purchase price and the method of payment.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Don't: Leave any sections blank; incomplete forms can lead to disputes.

- Don't: Use vague language when describing the item; specificity is key.

- Don't: Forget to verify the identity of the other party before signing.

- Don't: Alter the form after it has been signed; this can invalidate the agreement.

- Don't: Neglect to check local laws regarding Bill of Sale requirements, as they may vary.

How to Use Arizona Bill of Sale

Completing the Arizona Bill of Sale form is an important step in ensuring a smooth transaction when buying or selling a vehicle or other personal property. Once you have filled out the form accurately, both parties will need to sign it, and it may be beneficial to keep a copy for your records.

- Start by downloading the Arizona Bill of Sale form from a reliable source or obtain a physical copy.

- At the top of the form, enter the date of the transaction.

- Fill in the seller's information, including their full name, address, and contact number.

- Next, provide the buyer's information in the same manner: full name, address, and contact number.

- Describe the item being sold. Include details such as the make, model, year, Vehicle Identification Number (VIN) for vehicles, and any other relevant information.

- Indicate the sale price clearly. Make sure to specify the currency (e.g., dollars).

- If applicable, note any terms or conditions of the sale, such as warranties or “as-is” statements.

- Both the seller and buyer should sign the form. Ensure that both parties date their signatures.

- Make copies of the completed Bill of Sale for both the seller and buyer for their records.

Find Popular Bill of Sale Forms for US States

Vehicle Bill of Sale Free Pdf - Consider including a section for both parties to acknowledge the condition of the item sold.

Dmv Bill of Sale California - The form may include information on additional agreements or negotiations made during the sale.

Handwritten Bill of Sale - This document is crucial for legally transferring ownership of valuable items.

Documents used along the form

The Arizona Bill of Sale form is an important document for transferring ownership of personal property. However, it is often accompanied by other forms and documents that facilitate the transaction and provide additional legal protection. Below is a list of related documents commonly used in conjunction with the Arizona Bill of Sale.

- Title Transfer Document: This form officially transfers the title of a vehicle or property from the seller to the buyer. It is essential for ensuring that the new owner has legal rights to the asset.

- Vehicle Registration Application: When purchasing a vehicle, this application is necessary to register the vehicle with the state. It includes information about the buyer and the vehicle, ensuring proper documentation for legal ownership.

- Odometer Disclosure Statement: This document certifies the mileage on a vehicle at the time of sale. It helps prevent fraud by providing an accurate record of the vehicle's mileage.

- Affidavit of Ownership: In cases where a seller cannot provide a title, this affidavit serves as a sworn statement confirming ownership of the property being sold.

- Purchase Agreement: This contract outlines the terms of the sale, including the price and any conditions. It serves as a binding agreement between the buyer and seller.

- Release of Liability: This form protects the seller from future claims related to the property after the sale is completed. It ensures that the buyer assumes all responsibilities once the transaction is finalized.

- Sales Tax Receipt: This receipt documents the payment of sales tax on the transaction. It is often required for vehicle registration and can serve as proof of payment for tax purposes.

- Identification Documents: Both parties may need to provide valid identification, such as a driver's license or state ID, to verify their identities and facilitate the transaction.

Using these documents in conjunction with the Arizona Bill of Sale can help ensure a smooth and legally sound transaction. It is advisable to gather all necessary paperwork before completing any sale to avoid potential issues in the future.

Misconceptions

Understanding the Arizona Bill of Sale form is essential for anyone involved in buying or selling personal property. However, several misconceptions can lead to confusion. Here are eight common myths about the Arizona Bill of Sale form, along with clarifications.

- A Bill of Sale is not legally required. Many people believe a Bill of Sale is optional for private sales. While it's not always mandatory, having one provides proof of the transaction and protects both parties.

- All Bill of Sale forms are the same. This is false. Different types of transactions (like vehicles, boats, or personal property) may require specific information on the Bill of Sale.

- A Bill of Sale does not need to be notarized. Notarization is not always necessary in Arizona, but it can add an extra layer of security and credibility to the document.

- Once signed, a Bill of Sale cannot be changed. This is misleading. If both parties agree, they can create an amendment or a new Bill of Sale to reflect any changes.

- A Bill of Sale is only for selling vehicles. Many think this document is exclusive to vehicle transactions. In reality, it can be used for any personal property sale.

- The seller is responsible for all liabilities after the sale. This is not always true. Depending on the terms in the Bill of Sale, the buyer may assume certain responsibilities.

- A Bill of Sale guarantees ownership. While it serves as proof of the transaction, it does not guarantee that the seller has the legal right to sell the item.

- You don't need a Bill of Sale for gifts. Even for gifts, having a Bill of Sale can help clarify ownership and avoid future disputes.

Being informed about these misconceptions can help ensure smoother transactions and protect your interests when buying or selling property in Arizona.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | The Arizona Bill of Sale is a legal document used to transfer ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale in Arizona is governed by Arizona Revised Statutes, particularly Title 44, which covers sales and transactions. |

| Types of Transactions | This form can be used for various transactions, including vehicle sales, equipment sales, and personal property transfers. |

| Required Information | The form typically requires the names and addresses of both the buyer and seller, a description of the item, and the sale price. |

| Notarization | While notarization is not mandatory, having the document notarized can provide additional legal protection for both parties. |

| Use for Vehicle Sales | For vehicle sales, the Arizona Bill of Sale serves as proof of purchase and is often required for registration purposes. |

| Tax Implications | Sales tax may apply to certain transactions, and the seller is typically responsible for reporting the sale to the Arizona Department of Revenue. |

| Retention of Copies | Both the buyer and seller should retain copies of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Template Availability | Templates for the Arizona Bill of Sale can be found online, but it's advisable to ensure they comply with state laws. |

Key takeaways

Filling out and using the Arizona Bill of Sale form is an important step in ensuring a smooth transaction when buying or selling personal property. Here are key takeaways to consider:

- Purpose of the Bill of Sale: This document serves as a legal record of the transaction between the buyer and the seller, providing proof of ownership transfer.

- Required Information: Essential details must be included, such as the names and addresses of both parties, a description of the item being sold, and the sale price.

- Item Description: A thorough description of the item, including make, model, year, and any identifying numbers, helps prevent disputes in the future.

- Signatures: Both the buyer and seller should sign the Bill of Sale to validate the transaction. This step is crucial for legal recognition.

- Notarization: While notarization is not mandatory in Arizona, having the document notarized can add an extra layer of security and authenticity.

- Multiple Copies: It is advisable to create multiple copies of the completed Bill of Sale. Each party should retain a copy for their records.

- State-Specific Requirements: Always check for any additional requirements specific to Arizona, especially if the item being sold is a vehicle or other regulated property.

- Use in Future Transactions: The Bill of Sale can be used as a reference in future transactions or disputes, making it a valuable document to keep safe.