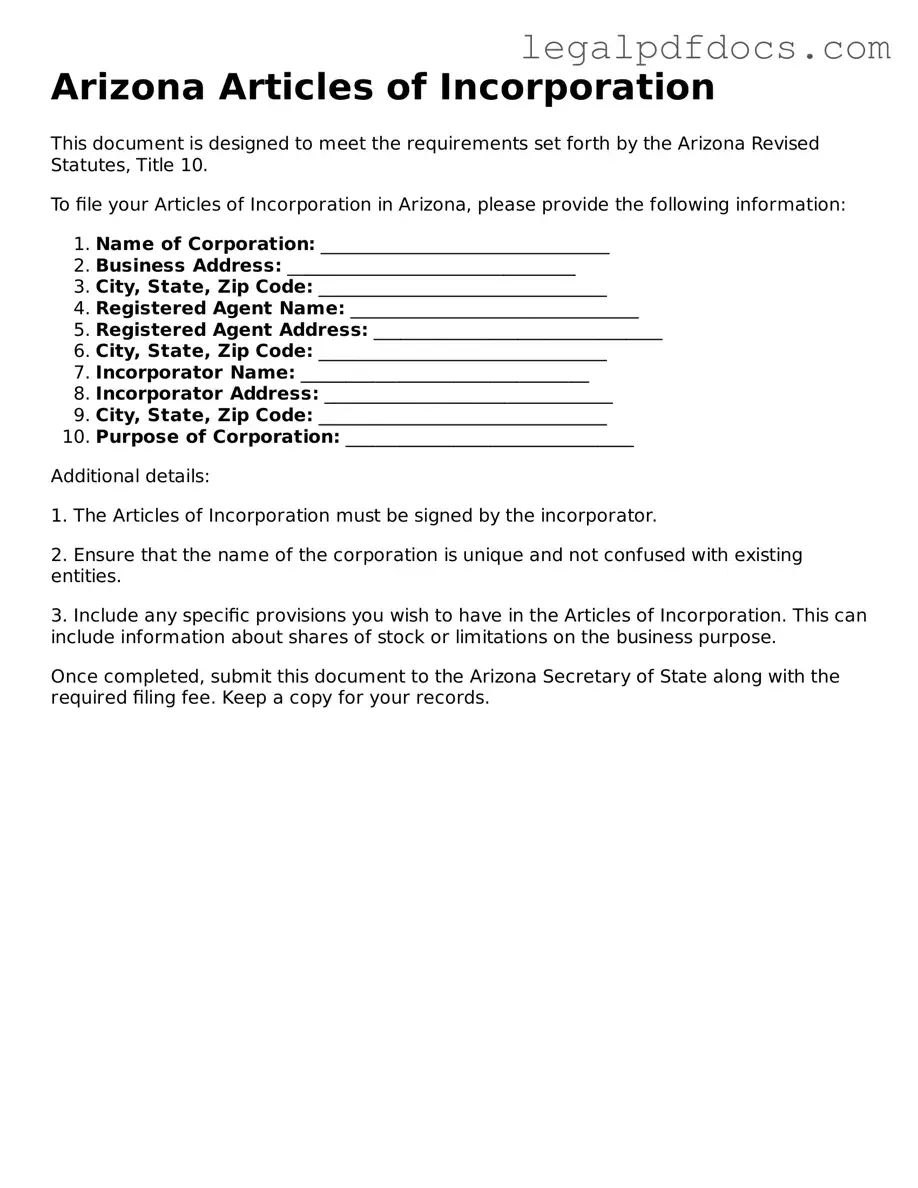

Official Articles of Incorporation Form for Arizona

When starting a business in Arizona, one of the first steps you will encounter is the completion of the Articles of Incorporation form. This essential document lays the foundation for your corporation and includes key information about your business. It typically requires details such as the name of your corporation, which must be unique and comply with state naming rules. You will also need to provide the address of your corporation's principal office, ensuring that it is a physical location within Arizona. Additionally, the form asks for the names and addresses of the initial directors, who will guide the corporation during its early stages. Another critical aspect involves specifying the corporation's purpose, which can range from general business activities to specific functions. Furthermore, you must indicate the type of stock your corporation will issue, including the number of shares and their par value. Completing the Articles of Incorporation accurately is vital, as it not only establishes your business legally but also helps you gain credibility with potential investors and customers.

Dos and Don'ts

When filling out the Arizona Articles of Incorporation form, attention to detail is crucial. Here are eight important dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and other details.

- Do use clear and concise language. Avoid unnecessary complexity to prevent confusion.

- Do include the required number of directors or incorporators. Arizona law specifies a minimum, so be aware of this requirement.

- Do provide a valid registered agent's name and address. This person or entity will receive legal documents on behalf of your corporation.

- Don't forget to sign the form. An unsigned form is not valid and will be rejected.

- Don't leave any required fields blank. Incomplete forms can lead to delays in processing.

- Don't use abbreviations for names or titles unless specified. Clarity is key in legal documents.

- Don't submit the form without paying the required filing fee. Ensure you check the current fee structure to avoid issues.

By following these guidelines, you can streamline the process of incorporating your business in Arizona and avoid common pitfalls.

How to Use Arizona Articles of Incorporation

Once you have gathered the necessary information, you can proceed to fill out the Arizona Articles of Incorporation form. This form is essential for establishing your business as a legal entity in the state. Ensuring accuracy and completeness is crucial, as any errors may delay the incorporation process.

- Begin by downloading the Arizona Articles of Incorporation form from the Arizona Corporation Commission's website.

- Provide the name of your corporation. Ensure that it complies with Arizona naming requirements and is not already in use.

- Fill in the purpose of your corporation. A brief description of the business activities should suffice.

- Indicate the duration of the corporation. Most corporations are set up to exist perpetually unless stated otherwise.

- Enter the name and address of the statutory agent. This individual or business will receive legal documents on behalf of the corporation.

- Specify the address of the corporation's principal office. This should be a physical address, not a P.O. Box.

- List the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. The incorporators must sign, confirming the information provided is accurate.

- Submit the completed form along with the required filing fee to the Arizona Corporation Commission. This can often be done online or via mail.

Find Popular Articles of Incorporation Forms for US States

Florida Division of Corporation - This document states the duration of the corporation's existence.

Business Formation - Incorporation can protect personal assets from business liabilities.

Georgia Secretary of State Forms - Compliance with federal and state laws is crucial in the articles.

Idaho Llc Registration - It may also detail the corporation's purpose and specific business activities.

Documents used along the form

When forming a corporation in Arizona, it's important to consider several other forms and documents that may be necessary alongside the Articles of Incorporation. Each of these documents serves a specific purpose in the incorporation process, ensuring compliance with state laws and regulations.

- Bylaws: These are the internal rules that govern how the corporation operates. Bylaws outline the roles of directors and officers, meeting procedures, and other operational guidelines.

- Initial Board of Directors Meeting Minutes: This document records the decisions made during the first meeting of the board of directors. It often includes the appointment of officers and the adoption of bylaws.

- Employer Identification Number (EIN) Application: This form is required for tax purposes. It allows the corporation to hire employees and open bank accounts.

- Statement of Information: This document provides essential information about the corporation, such as its address and the names of its officers and directors. It must be filed periodically.

- Business Licenses and Permits: Depending on the type of business, various licenses and permits may be required at the local, state, or federal level to operate legally.

- Shareholder Agreements: This agreement outlines the rights and responsibilities of shareholders. It can help prevent disputes and clarify how shares can be bought or sold.

- Operating Agreements (for LLCs): While not applicable to corporations, if forming an LLC, this document outlines the management structure and operating procedures of the business.

- Annual Reports: Corporations are often required to file annual reports with the state. These reports provide updated information about the corporation's activities and financial status.

- Registered Agent Consent Form: This document confirms that the registered agent has agreed to accept legal documents on behalf of the corporation.

- Certificate of Good Standing: This document verifies that the corporation is legally registered and compliant with state requirements. It may be necessary for certain business transactions.

Completing these documents accurately is crucial for a smooth incorporation process. By understanding each form's purpose, individuals can ensure that their corporation is set up correctly and operates within the legal framework established by Arizona law.

Misconceptions

Understanding the Arizona Articles of Incorporation form is crucial for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion and potential errors in the filing process. Below are four common misconceptions along with clarifications.

- Misconception 1: The Articles of Incorporation are the only requirement to start a business in Arizona.

- Misconception 2: Anyone can file Articles of Incorporation without any restrictions.

- Misconception 3: The Articles of Incorporation must be filed in person.

- Misconception 4: Once filed, the Articles of Incorporation cannot be changed.

This is incorrect. While the Articles of Incorporation are essential for legally establishing a corporation, additional steps are necessary. These may include obtaining business licenses, registering for taxes, and complying with local regulations.

In reality, there are specific requirements for who can file. Typically, at least one incorporator is needed, and this person must be at least 18 years old. Additionally, the corporation must have a registered agent with a physical address in Arizona.

This is a misunderstanding. Arizona allows for online submissions, which can expedite the process. Filing by mail is also an option. Each method has its own requirements and timelines, but in-person filing is not mandatory.

This is not true. Amendments to the Articles of Incorporation can be made after the initial filing. Changes may be necessary to update the corporation's name, address, or structure, and the process for amending these documents is clearly outlined by the state.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Articles of Incorporation form is used to establish a corporation in the state of Arizona. |

| Governing Law | This form is governed by Arizona Revised Statutes Title 10, Chapter 29. |

| Filing Requirements | To file, the form must be submitted to the Arizona Corporation Commission along with the required fee. |

| Information Needed | Key information includes the corporation's name, address, and details about the registered agent. |

| Amendments | Once filed, any changes to the corporation's structure or information require an amendment to the Articles of Incorporation. |

Key takeaways

When filling out the Arizona Articles of Incorporation form, keep these key takeaways in mind:

- Choose a unique name for your corporation. It must not be the same as or too similar to existing businesses in Arizona.

- Include the purpose of your corporation. Be clear and concise about what your business will do.

- Designate a statutory agent. This person or entity will receive legal documents on behalf of your corporation.

- Provide the number of shares the corporation is authorized to issue. This affects ownership and investment options.

- List the initial directors of the corporation. They will manage the company until the first shareholders' meeting.

- Ensure you sign the form. The incorporator must sign to validate the document.

- File the form with the Arizona Corporation Commission. Submit it online or via mail along with the required filing fee.

- Keep a copy of the filed Articles of Incorporation. This document serves as proof of your corporation’s existence.