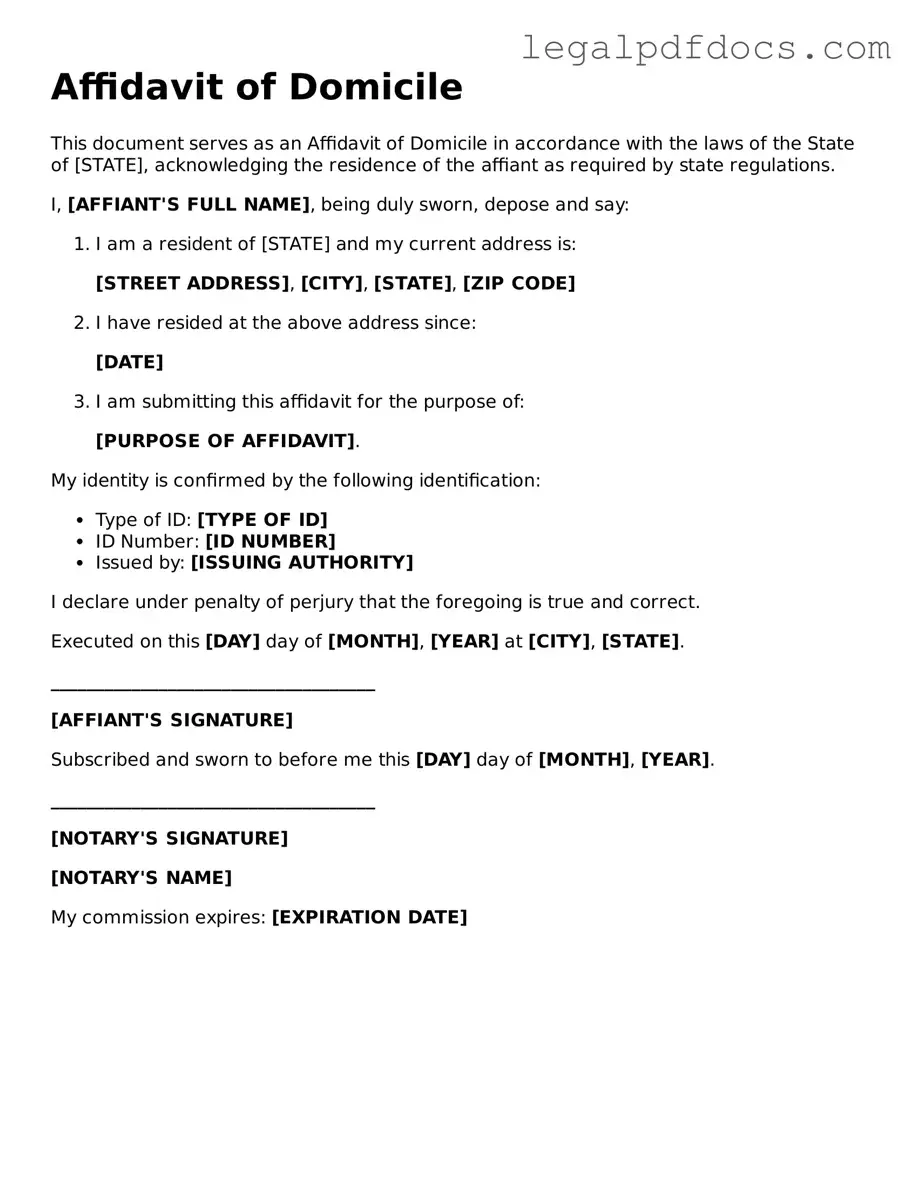

Affidavit of Domicile Template

The Affidavit of Domicile form plays a crucial role in establishing an individual's legal residence, particularly in matters related to estate planning and probate. This document serves as a sworn statement that affirms where a person considers their permanent home to be. It is often required when settling the estate of a deceased individual, ensuring that assets are distributed according to the laws of the state where the deceased was domiciled. The form typically includes essential information such as the individual's name, the address of their primary residence, and the date of death if applicable. Notably, it may also require the signatures of witnesses or a notary public to validate the claims made within. Understanding how to correctly complete and file this form is vital for executors and beneficiaries alike, as it can significantly impact the administration of an estate and the distribution of assets. Timely and accurate submission can help avoid legal complications and ensure a smoother transition during what is often a challenging time for families.

Dos and Don'ts

When filling out the Affidavit of Domicile form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should do and five things you shouldn't do.

- Do provide accurate information regarding your current residence.

- Do sign the affidavit in front of a notary public.

- Do include the date when you established your domicile.

- Do keep a copy of the completed form for your records.

- Do ensure all sections of the form are filled out completely.

- Don't use incorrect or outdated information about your residence.

- Don't forget to check for any required witnesses, if applicable.

- Don't leave any sections blank unless specifically instructed.

- Don't submit the form without reviewing it for errors.

- Don't rush the process; take your time to ensure everything is correct.

How to Use Affidavit of Domicile

After obtaining the Affidavit of Domicile form, it’s important to ensure that all required information is accurately filled out. This form is typically used to confirm a person's legal residence. Once completed, it will need to be signed and possibly notarized before submission.

- Gather necessary information: Collect details such as your full name, address, and any relevant identification numbers.

- Begin with your personal information: Fill in your name and current address at the top of the form.

- Provide additional details: Include any previous addresses if required, along with the dates you lived there.

- State your intent: Clearly indicate your intention to affirm your residence by checking the appropriate box or writing a statement if necessary.

- Sign the form: Make sure to sign and date the affidavit at the designated area.

- Notarization: If required, take the completed form to a notary public to have it notarized.

- Submit the form: Finally, send the completed affidavit to the appropriate authority or retain it for your records as needed.

Check out Popular Types of Affidavit of Domicile Templates

Who Is the Petitioner in I-751 - Clear and honest statements are essential in these letters.

Affidavit of Death California Pdf - A document used to convey the fact of death to relevant authorities.

Letter to Confirm Residence - Individuals often use it for applying for public benefits.

Documents used along the form

The Affidavit of Domicile is an important document that establishes a person's legal residence. Often, it is used in conjunction with several other forms and documents to ensure a smooth process in legal and financial matters. Below is a list of related documents that may be needed alongside the Affidavit of Domicile.

- Last Will and Testament: This document outlines how a person's assets will be distributed upon their death. It is essential for ensuring that the deceased's wishes are honored and can help clarify domicile issues.

- Power of Attorney: This legal document allows one person to act on behalf of another in financial or legal matters. It can be crucial for managing affairs, especially if the individual is unable to do so themselves.

- Certificate of Death: This official document confirms a person's death and is often required when settling an estate or transferring assets. It provides necessary proof when submitting the Affidavit of Domicile.

- Trust Documents: If a person has established a trust, these documents outline how the trust operates and how assets are managed. They may be referenced in conjunction with the Affidavit to clarify asset distribution.

- Tax Returns: Previous tax returns may be needed to establish residency for tax purposes. They can provide evidence of where an individual has lived and their financial ties to a specific location.

- Property Deeds: These documents prove ownership of real estate. They can help establish domicile by showing where an individual owns property and may reside.

- Bank Statements: Recent bank statements can support claims of residency by showing where an individual conducts their banking activities. They may serve as proof of domicile in legal proceedings.

When preparing to use the Affidavit of Domicile, it is beneficial to gather these related documents. Each one plays a role in clarifying residency and ensuring that legal matters are handled appropriately. By having everything organized, individuals can navigate the process more effectively.

Misconceptions

The Affidavit of Domicile is a vital document, yet many people hold misconceptions about its purpose and use. Here are ten common misunderstandings:

- It's only for wealthy individuals. Many believe that only affluent people need an Affidavit of Domicile. In reality, anyone can benefit from this document, especially when establishing residency for legal or tax purposes.

- It is the same as a will. Some think the Affidavit of Domicile serves the same function as a will. However, it does not distribute assets; it simply confirms a person's primary residence.

- It's only necessary after death. While often used in estate matters, this affidavit can be helpful during a person's lifetime, particularly for tax residency or legal identification.

- Anyone can create one without formalities. Although it may seem simple, an Affidavit of Domicile typically requires notarization to be legally binding and accepted by institutions.

- It guarantees tax benefits. Some people mistakenly believe that filing an Affidavit of Domicile automatically secures tax benefits. In truth, it merely establishes residency; actual tax benefits depend on various other factors.

- It can be used in any state without modification. Each state has its own rules and requirements for an Affidavit of Domicile. Therefore, using a form from one state in another may not be valid.

- It is a one-time document. Many think that once an Affidavit of Domicile is filed, it never needs to be updated. However, changes in residency or personal circumstances may require a new affidavit.

- It is only for real estate ownership. While often associated with property, this affidavit can also clarify residency for various legal matters, not just real estate.

- Filing is a complicated process. Although it may seem daunting, filing an Affidavit of Domicile is generally straightforward and can often be completed with minimal guidance.

- It's not legally enforceable. Some individuals believe that an Affidavit of Domicile holds no legal weight. In fact, it is a sworn statement and can be used in legal proceedings to establish residency.

Understanding these misconceptions can help individuals navigate the process of creating and using an Affidavit of Domicile effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Affidavit of Domicile is used to declare a person's primary residence, often required for estate matters or when transferring assets. |

| Legal Requirement | In many states, this form is necessary for settling estates or for tax purposes, ensuring that the deceased's assets are distributed according to their wishes. |

| State Variations | Each state may have its own version of the Affidavit of Domicile, governed by state laws such as California Probate Code Section 13100 or New York Estates, Powers and Trusts Law § 3-2.1. |

| Signature Requirement | The form typically requires the signature of the affiant, who must be a competent adult, and may need to be notarized to ensure authenticity. |

| Filing Process | Once completed, the affidavit is usually filed with the local probate court or attached to other legal documents related to the estate. |

Key takeaways

Filling out the Affidavit of Domicile form is an important step for various legal and financial purposes. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Affidavit of Domicile is used to declare your primary residence. This document is often required for estate planning, tax purposes, or when transferring assets.

- Provide Accurate Information: Ensure that all details, including your name, address, and the date of signing, are correct. Inaccuracies can lead to complications down the line.

- Signature Requirements: The form typically requires your signature, and in some cases, it may need to be notarized. Check local regulations to confirm what is needed.

- Keep Copies: After completing the form, make copies for your records. This can be helpful if you need to reference it in the future.

- Consult a Professional: If you have questions or concerns about filling out the form, consider seeking advice from a legal expert. They can provide guidance tailored to your situation.

By following these guidelines, you can ensure that your Affidavit of Domicile is completed correctly and serves its intended purpose effectively.