Fill Out a Valid Adp Pay Stub Template

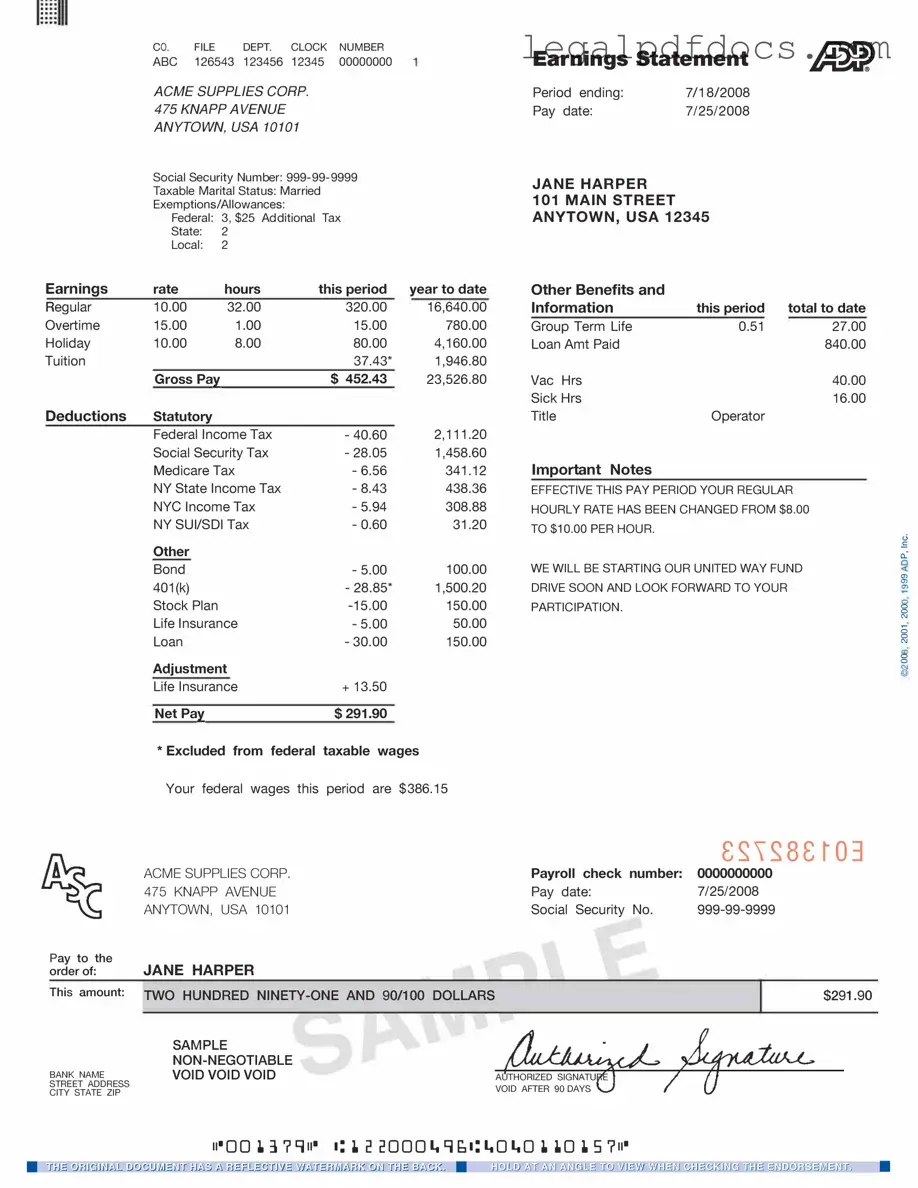

The ADP Pay Stub form serves as a crucial document for employees, providing a detailed breakdown of their earnings and deductions for each pay period. It outlines gross pay, which reflects the total earnings before any deductions, and net pay, the amount that employees take home after taxes and other deductions. Additionally, the form includes information on various deductions such as federal and state taxes, Social Security, and retirement contributions. Understanding these components is essential for employees to manage their finances effectively and ensure that their paychecks align with their expectations. The pay stub also often features year-to-date figures, allowing employees to track their earnings and deductions over time. By reviewing this form regularly, employees can stay informed about their financial status and make informed decisions regarding budgeting and savings.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s important to get it right. Here are some key things to keep in mind:

- Do: Double-check all personal information for accuracy.

- Do: Include your correct employee ID number.

- Do: Review your pay period dates carefully.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use incorrect or outdated information.

Following these guidelines can help ensure that your pay stub is processed smoothly and accurately.

How to Use Adp Pay Stub

When preparing to fill out the ADP Pay Stub form, it is essential to gather all necessary information beforehand. This ensures a smooth process and helps to avoid any potential errors. Below are the steps to guide you through completing the form accurately.

- Begin by locating the ADP Pay Stub form. Ensure you have the most recent version to avoid any discrepancies.

- Fill in your personal information at the top of the form. This includes your full name, address, and employee identification number.

- Next, provide your employer’s name and address. Make sure this information is correct to ensure proper record-keeping.

- Enter your pay period dates. Clearly indicate the start and end dates for the pay period you are documenting.

- List your hours worked during the pay period. Include regular hours, overtime, and any other relevant time worked.

- Input your gross pay. This is the total amount earned before any deductions are taken out.

- Detail any deductions that apply to your pay. This may include taxes, health insurance, retirement contributions, and any other withholdings.

- Calculate your net pay, which is the amount you will receive after all deductions have been made.

- Review all the information for accuracy. Double-check names, numbers, and dates to ensure everything is correct.

- Once confirmed, sign and date the form at the bottom to validate your information.

Following these steps will help ensure that your ADP Pay Stub form is completed correctly and efficiently. Accurate record-keeping is vital for both personal finance management and compliance with employer requirements.

More PDF Templates

Security Guard Example Incident Report Writing - Ensure all sections of the form are completed for best practices.

Broward County Animal Care - Each vaccination session should be recorded with relevant details.

T47 Paralympics - It can assist in clarifying the rights of the property owner versus any tenants.

Documents used along the form

The ADP Pay Stub form is a crucial document for employees, providing a detailed breakdown of earnings and deductions. Several other forms and documents often accompany the pay stub, each serving a specific purpose in managing payroll and employee information.

- W-2 Form: This document summarizes an employee's total earnings and tax withholdings for the year. It is essential for filing annual income tax returns.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their paychecks directly into their bank accounts, ensuring timely access to funds.

- Employee Information Form: This form collects personal details from employees, including contact information, tax withholding preferences, and emergency contacts. It is vital for maintaining accurate records.

- Time Sheet: Employees fill out this document to record hours worked during a pay period. It helps ensure accurate payment for hours worked and is often required for payroll processing.

Understanding these documents is essential for employees to manage their finances effectively. Each form plays a significant role in ensuring accurate payroll processing and compliance with tax regulations.

Misconceptions

Understanding the ADP pay stub form is essential for employees and employers alike. However, several misconceptions can lead to confusion. Here are five common misconceptions about the ADP pay stub form:

-

All deductions are the same for every employee.

This is not true. Deductions can vary based on individual circumstances, such as tax withholding preferences, benefits selections, and state-specific regulations.

-

The pay stub only reflects gross pay.

In reality, the pay stub provides a detailed breakdown of gross pay, net pay, and all deductions, allowing employees to see how their earnings are calculated.

-

Pay stubs are only important for tax purposes.

While they are crucial for tax filing, pay stubs also serve as proof of income for loans, rentals, and other financial transactions.

-

ADP pay stubs are difficult to read.

ADP designs its pay stubs to be user-friendly. Key information is clearly labeled, making it easier for employees to understand their earnings and deductions.

-

You can’t access past pay stubs.

This is incorrect. Employees can typically access their pay stubs online through ADP's portal, allowing them to review past pay information whenever needed.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The form typically includes information such as gross pay, net pay, taxes withheld, and other deductions like health insurance or retirement contributions. |

| Frequency | Employees receive the pay stub on a regular basis, usually coinciding with their pay schedule, such as weekly, bi-weekly, or monthly. |

| State-Specific Requirements | Some states have specific laws regarding pay stubs. For example, California requires employers to provide detailed pay stubs under California Labor Code Section 226. |

| Access | Employees can access their pay stubs online through ADP’s secure portal or receive them in paper form, depending on employer preferences. |

| Record Keeping | Employees should keep their pay stubs for their records, as they can be useful for tax purposes and verifying income. |

| Discrepancies | If there are any discrepancies on the pay stub, employees should report them to their employer’s payroll department for resolution. |

Key takeaways

When dealing with the ADP Pay Stub form, it’s important to understand the key components and how to effectively use this document. Here are some essential takeaways:

- ADP Pay Stubs provide a detailed breakdown of your earnings for each pay period.

- Each pay stub includes your gross pay, taxes withheld, and net pay, allowing for easy tracking of your income.

- Review the deductions section carefully; it lists all withholdings such as federal and state taxes, Social Security, and health insurance.

- Pay stubs are typically issued electronically, making them easily accessible through your ADP account.

- Keep your pay stubs for personal records; they can be useful for budgeting and tax preparation.

- Employers often provide year-end summaries, but reviewing your pay stubs throughout the year can help catch any discrepancies early.

- If you notice any errors, contact your HR department or payroll administrator promptly.

- Understanding your pay stub can help you make informed decisions about your finances and benefits.

- ADP Pay Stubs may also provide information about your vacation and sick leave balances.

- Familiarize yourself with the layout of your pay stub to quickly locate important information.

By keeping these points in mind, you can navigate your ADP Pay Stub with confidence and clarity.