Fill Out a Valid Acord 130 Template

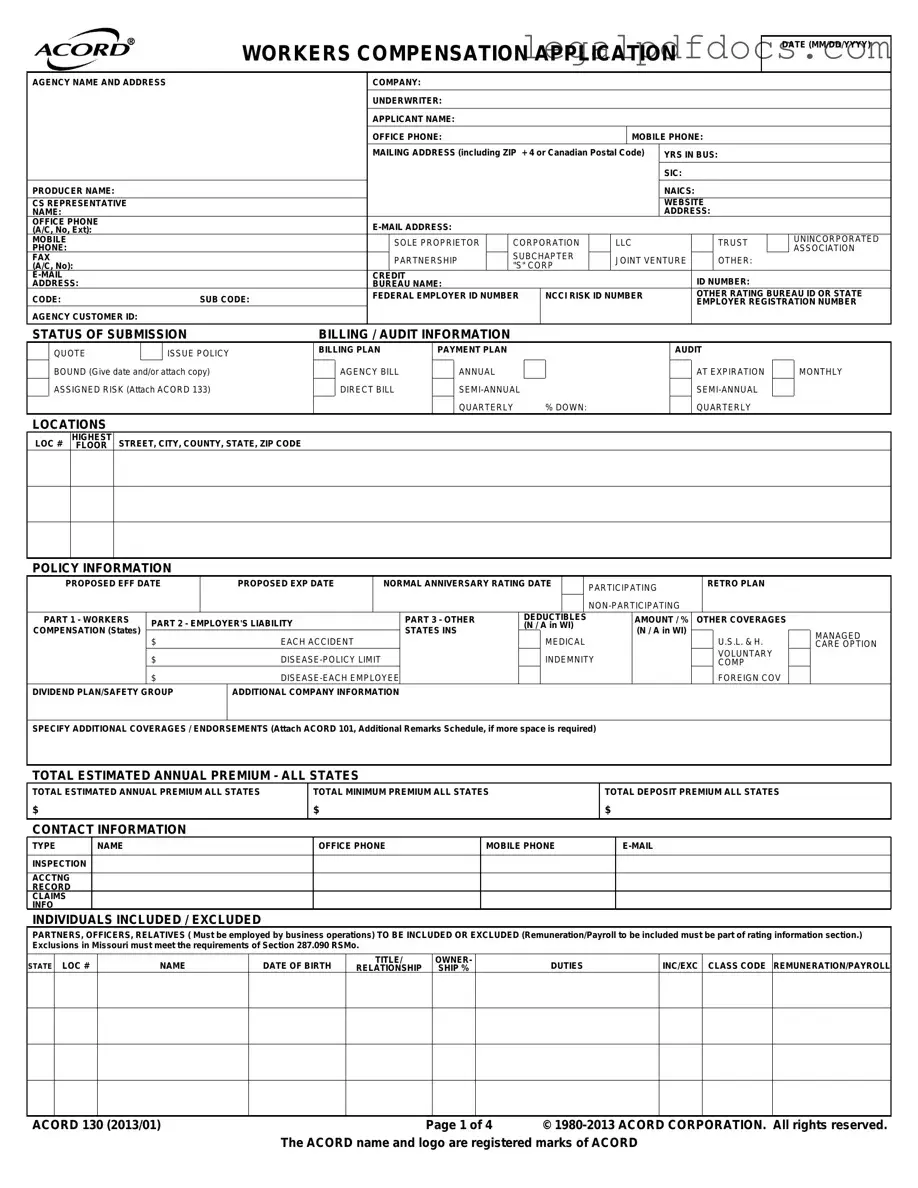

The ACORD 130 form serves as a critical tool in the realm of workers' compensation insurance applications. This form collects essential information about businesses seeking coverage, including details about the applicant, their operations, and their insurance needs. Key sections of the form require the applicant to provide their agency name, contact information, and business structure, whether it be a corporation, partnership, or sole proprietorship. Additionally, the form asks for specifics on the nature of the business, including the number of employees and their roles. It also captures vital data regarding prior insurance coverage and loss history, which can significantly impact the underwriting process. Furthermore, the ACORD 130 outlines various policy options, including coverage limits and deductibles, allowing businesses to tailor their insurance to fit their unique circumstances. By providing a comprehensive overview of the applicant's operations and insurance history, the ACORD 130 plays a crucial role in ensuring that businesses receive appropriate coverage to protect their employees and operations.

Dos and Don'ts

When filling out the ACORD 130 form, it's crucial to ensure accuracy and completeness. Here are four key dos and don'ts to keep in mind:

- Do: Provide accurate and up-to-date contact information for all parties involved, including the agency and applicant.

- Do: Include all relevant details about your business operations, including the nature of your work and any subcontractors used.

- Don't: Leave any sections blank unless instructed. Incomplete forms can lead to delays or complications in processing your application.

- Don't: Conceal any past claims or loss history. Transparency is vital for a smooth application process.

How to Use Acord 130

Completing the Acord 130 form is essential for those applying for workers' compensation insurance. The information you provide will help insurers assess your business and determine your coverage needs. Below are the steps to guide you through the process of filling out this important document.

- Date: Enter the date of your application in the format MM/DD/YYYY.

- Agency Information: Fill in the name and address of your insurance agency.

- Company and Underwriter: Provide the name of the insurance company and the underwriter responsible for your application.

- Applicant Information: Write the applicant's name, office phone number, mobile phone number, and mailing address, including ZIP + 4 or Canadian Postal Code.

- Business Details: Indicate how many years you have been in business and your Standard Industrial Classification (SIC) code. Also, include your North American Industry Classification System (NAICS) code.

- Producer Information: Fill in the producer's name, office phone number, and email address.

- Business Structure: Check the appropriate box to indicate your business structure (e.g., sole proprietor, corporation, LLC, etc.).

- Contact Information: Provide the contact information for individuals involved in the application, including their names, office phone numbers, mobile phone numbers, and email addresses.

- Policy Information: Enter the proposed effective and expiration dates for the policy, along with any relevant rating information.

- Workers Compensation Coverage: Fill in the coverage amounts, including limits for each accident and disease, as well as any deductibles.

- Additional Company Information: Specify any additional coverages or endorsements you require.

- Estimated Premiums: Provide the total estimated annual premium, minimum premium, and deposit premium for all states.

- Prior Carrier Information: List the information for your insurance carrier from the past five years, including any claims history.

- General Information: Answer the yes/no questions regarding your business operations and provide explanations where necessary.

- Signature: The application must be signed by an authorized representative of the applicant, along with the date of signing.

Once you’ve completed the form, review all entries for accuracy. It’s crucial that the information provided is correct, as inaccuracies can lead to delays or complications with your insurance application. After verifying everything, submit the form to your insurance agency for processing.

More PDF Templates

Act of Donation Louisiana Pdf - Many choose this form for its simplicity and effectiveness in documenting gifts.

What Is Immunization Records - Children who meet vaccination requirements can prevent serious illnesses and outbreaks.

Adp I Pay - It instills confidence in employees regarding their payment processes.

Documents used along the form

The Acord 130 form is a critical document used in the application process for workers' compensation insurance. Alongside this form, several other documents are often required to provide a comprehensive view of the applicant's business operations, financial standing, and insurance needs. Below is a list of commonly associated forms and documents that may accompany the Acord 130 form.

- Acord 133: This form is used for the Assigned Risk Plan. It provides detailed information about the applicant's business and helps insurers assess the risk involved in providing coverage.

- Acord 101: Known as the Additional Remarks Schedule, this document allows applicants to provide extra information or clarifications that may not fit within the confines of the Acord 130 form.

- Loss Run Report: This report details the applicant's claims history over the past few years. It is essential for insurers to evaluate past claims and potential future risks.

- State Rating Worksheet: This worksheet is used to calculate the premium based on the specific state regulations and classifications that apply to the applicant's business.

- Employer's Liability Insurance Application: This document is often required to provide coverage for claims that are not covered under workers' compensation, such as employee lawsuits for workplace injuries.

- Business Description: A detailed description of the nature of the business, including operations, products, and services offered. This information helps insurers understand the specific risks associated with the business.

- Financial Statements: Recent financial statements may be requested to assess the financial health of the business and its ability to pay premiums.

- Safety Program Documentation: If the applicant has a safety program in place, documentation may be required to demonstrate the effectiveness of safety measures taken to prevent workplace injuries.

- Employee Payroll Records: These records provide information on the number of employees and their respective salaries, which are crucial for determining the appropriate coverage and premiums.

Each of these documents plays a significant role in the evaluation process for workers' compensation insurance. By providing comprehensive and accurate information, applicants can facilitate a smoother underwriting process and ensure they receive the appropriate coverage for their business needs.

Misconceptions

Misconceptions about the ACORD 130 Form

- It's Only for Large Businesses: Many believe the ACORD 130 form is only necessary for big companies. In reality, any business with employees, regardless of size, needs to complete this form for workers' compensation insurance.

- It's a One-Time Requirement: Some think they only need to fill out the ACORD 130 once. However, businesses must update this form regularly, especially when there are changes in operations or employee numbers.

- All Information is Optional: Many assume that they can skip sections on the form. Each part is crucial for accurately assessing risk and determining premiums, so all information should be provided.

- Only Payroll Information is Important: Some focus solely on payroll numbers. While payroll is significant, other details about business operations and employee roles are equally important for accurate coverage.

- The Form is Standard Across States: It's a common belief that the ACORD 130 is the same in every state. In fact, specific requirements may vary by state, and businesses should check local regulations.

- Submitting the Form Guarantees Coverage: Many think that simply submitting the ACORD 130 ensures coverage. Coverage is contingent on approval from the insurance company after reviewing the submitted information.

- It's Only for New Policies: Some believe the ACORD 130 is only needed for new insurance policies. Existing policyholders must also submit this form when renewing or updating their coverage.

- Only the Owner Needs to Sign: There's a misconception that only the business owner must sign the form. In fact, an authorized representative, such as an officer or partner, must sign to validate the application.

- It's Not Necessary for Independent Contractors: Some think that if they use independent contractors, they don't need the form. However, if these contractors are treated like employees, they may still require coverage, and the form must reflect this.

- The Form is Easy to Complete: Many underestimate the complexity of the ACORD 130. While it may seem straightforward, gathering accurate information and understanding requirements can be challenging.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The ACORD 130 form is used to apply for workers' compensation insurance, providing essential information about the applicant's business and operations. |

| Governing Law | In Missouri, exclusions must meet the requirements of Section 287.090 RSMo. Other states may have specific regulations governing the use of this form. |

| Required Information | The form requires details such as the applicant's name, business type, estimated annual premium, and information about employees included or excluded from coverage. |

| Submission Process | Once completed, the form must be signed by an authorized representative of the applicant and submitted to the insurance agency for processing. |

Key takeaways

Filling out the ACORD 130 form is a crucial step in applying for workers' compensation insurance. Here are key takeaways to keep in mind:

- Accurate Information: Provide precise details about your business, including the name, address, and type of business entity. Errors can lead to delays or denials.

- Contact Details: Ensure all contact information is up-to-date. This includes phone numbers and email addresses for easy communication.

- Employee Information: Clearly list all employees, including their roles, salaries, and any exclusions. This is vital for calculating premiums accurately.

- Coverage Needs: Specify the types of coverage you require. This includes workers' compensation and employer's liability, among others.

- Prior Loss History: Be prepared to provide information on any claims made in the past five years. This history can impact your premium rates.

- Signature Requirement: The form must be signed by an authorized representative of the business. This confirms the accuracy of the information provided.

- Review Before Submission: Double-check all entries for accuracy. Mistakes or omissions can complicate the underwriting process.

By adhering to these guidelines, you can streamline the application process and enhance your chances of obtaining the necessary coverage.